In a move that has unsettled the global automotive sector, the United States announced last week the imposition of a 25 percent tariff on imported vehicles and parts, effective April 3, 2025. This decision introduces a significant challenge for automakers already grappling with declining demand in China and regulatory pressures in Europe.

In a move that has unsettled the global automotive sector, the United States announced last week the imposition of a 25 percent tariff on imported vehicles and parts, effective April 3, 2025. This decision introduces a significant challenge for automakers already grappling with declining demand in China and regulatory pressures in Europe.

Felipe Munoz, Global Analyst at Jato Dynamics, remarked, “The rollout of these tariffs is yet another problem for the industry to navigate. The U.S. is the world’s second-largest vehicle market, and it will now be more difficult than ever for the vast majority of non-Chinese automakers around the world to trade.”

According to Jato Dynamics, of the 16.1 million new light vehicles sold in the U.S. in 2024, approximately 6.3 million were imported, primarily from Mexico, Canada, the European Union, the United Kingdom, Japan, and South Korea. These imports now face the newly imposed 25 percent tariff. Furthermore, starting May 3, 2025, these measures will extend to include automotive parts manufactured outside the United States.

Impact on Domestic Automakers

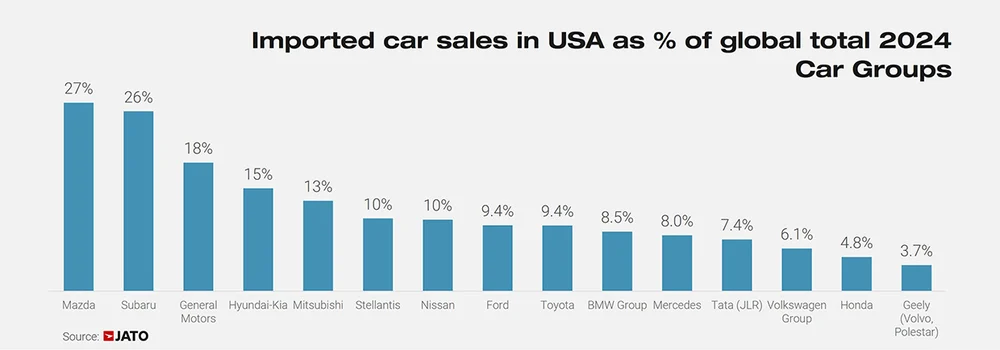

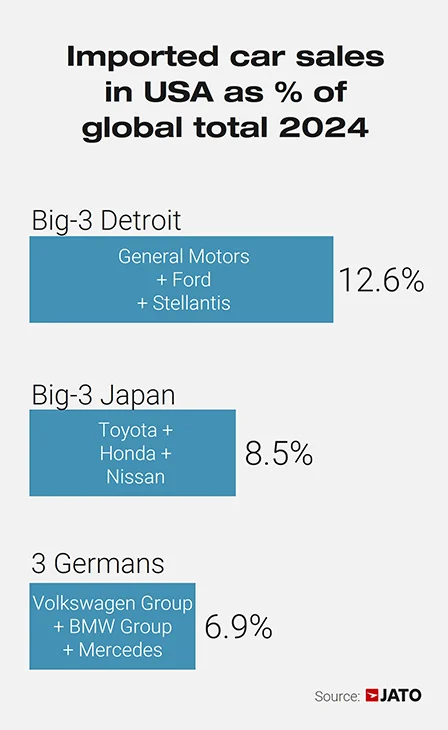

The tariffs’ repercussions are expected to vary among car manufacturers. Detroit’s “Big Three”—General Motors, Ford, and Stellantis—sold about 1.85 million imported light vehicles in the U.S. in 2024, representing 13 percent of their combined global sales. In contrast, Japanese automakers Toyota, Honda, and Nissan sold 17.9 million units globally last year, with 1.53 million units imported and sold in the U.S., accounting for 9 percent of their total sales. German manufacturers Volkswagen Group, BMW Group, and Mercedes-Benz saw U.S. demand for their imported cars make up 7 percent of their combined global sales.

While the intent behind the new trade policy is to bolster domestic carmakers, these manufacturers may also experience adverse effects. With a more concentrated global presence compared to some Japanese and European counterparts, U.S. manufacturers rely heavily on domestic sales. Consequently, tariffs on vehicles imported mainly from Mexico, Canada, and South Korea could have a pronounced impact.

Challenges for Other Brands

Certain brands are particularly vulnerable to the imposed tariffs. Mazda, for instance, sold 1.28 million new cars globally in 2024, with 343,000 of these vehicles imported and sold in the U.S. Subaru’s U.S. sales constituted 71 percent of its total in 2024, and while a significant portion was produced at its Indiana facility, imports still represented 26 percent of the brand’s global volume.

General Motors also faces substantial exposure, with sales of imported vehicles in the U.S. accounting for 18 percent of its total global sales—the highest percentage among the world’s five largest automakers.

Volkswagen Group’s Position

In 2024, the U.S. accounted for less than 10 percent of Volkswagen Group’s global sales. While this suggests a lower dependency compared to other major carmakers, approximately 80 percent of its U.S. sales were vehicles produced abroad, indicating potential challenges ahead.

Munoz added, “The U.S. is a vital market to 14 of the 18 non-Chinese global carmakers. For the likes of Volkswagen, the U.S. contributes a relatively small amount of the brand’s total revenue, but it will seek to hold a presence to retain its position as a global brand. Alongside Volkswagen, it is likely that Volvo, Hyundai-Kia, Mercedes, BMW, Stellantis, Toyota, Nissan, Subaru, and General Motors will need to increase their production footprint in the U.S. in the near future. The U.S. is a market that they can’t leave.”

As the industry adjusts to these new tariffs, automakers may need to reassess their production and supply chain strategies to mitigate potential disruptions and maintain their positions in the critical U.S. market.