The study, which assessed 4,023 dealerships across all major brands, examined response times and quality across email, telephone, text, and chat within the first 24 hours of an inquiry. Subaru’s score rose by nine points from the previous year, reaching an industry-high of 77. The brand’s dealers were significantly more proactive, responding through multiple communication channels 71% of the time, compared to an industry average of 49%. Additionally, only 8% of Subaru dealers failed to provide a personal response—less than half of the industry-wide failure rate of 19%.

Steady Gains in Digital Responsiveness

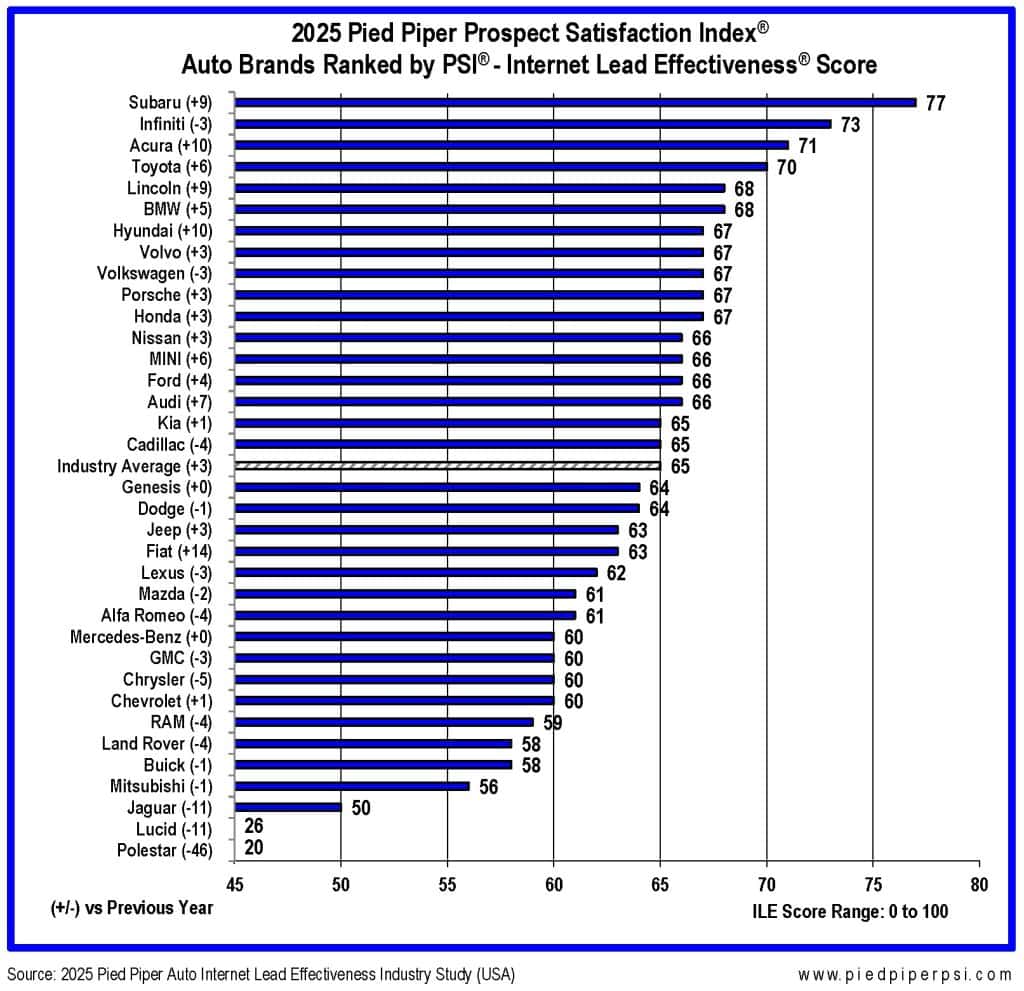

Overall, the industry’s average ILE score climbed three points to 65, marking the highest recorded average in the study’s history. Among the brands making the most notable improvements were Acura, Hyundai, Subaru, Lincoln, and Fiat, each posting gains of nine points or more. The upward trend over the past five years has been pronounced; in 2021, only eight brands achieved an ILE score of 60 or higher, whereas 28 brands met or exceeded that benchmark in 2025.

Key Improvements in Dealership Response

Measured dealer behaviors showed notable gains in 2025. The percentage of dealerships reaching out through multiple channels increased from 44% last year to 49% this year. Dealers also became more adept at addressing customer questions directly, doing so 69% of the time via email or text, up from 59% in 2024. Further, 73% of email responses in the 2025 study included suggested next steps, an increase from 67%, while 27% provided compelling reasons to buy from that dealership, up from 22%.

Areas of Decline in Communication Trends

Despite these improvements, certain aspects of dealer responsiveness showed signs of regression. The proportion of dealers using text messaging fell from 70% in 2024 to 64% this year, although the number of texts that answered a customer’s specific question increased from 34% to 38%. Phone responses also saw a slight decline, with dealers making calls to web customers 66% of the time compared to 68% last year.

The 80/40 Rule: A Dividing Line Between Success and Failure

Pied Piper’s ILE study highlights a stark contrast between high-performing and underperforming dealerships. This year, 40% of dealerships scored above 80, indicating a swift and thorough personal response, while 19% scored below 40, meaning they failed to respond at all. The shift from last year’s figures (+6% in the top tier and -2% in the bottom) suggests gradual but meaningful progress.

“The effort to improve is worth it,” said Cameron O’Hagan, Vice President of Metrics and Analytics at Pied Piper. “Historically, dealers who elevate their ILE performance from below 40 to above 80 sell 50% more units from the same number of internet leads.”

Bridging the Digital Divide: The Next Step for Dealerships

The data reinforces a key takeaway: multi-channel communication is crucial. Customers often overlook emails, ignore phone calls, or find text messages intrusive, making it essential for dealerships to employ multiple touchpoints. While 85% of dealers in this year’s study responded to online inquiries via at least one method, only 49% used multiple communication paths.

“A consistent multi-pronged response to every customer is critical,” said O’Hagan. “You never know in advance which communication method will be most effective at reaching a specific customer.”

Brand Comparisons: The Leaders and Laggards in Digital Responsiveness

The 2025 study revealed wide disparities in dealership responsiveness across brands:

- Answered Question Promptly: Subaru, Infiniti, and Porsche led the industry, providing answers via email or text within 60 minutes more than 70% of the time. Brands such as GMC, Buick, Mitsubishi, Jaguar, Polestar, and Lucid fell below 50%.

- Phoned Customers Quickly: Subaru, Infiniti, Honda, and Lincoln dealers called customers within 60 minutes more than 60% of the time, while Dodge, Chevrolet, Mitsubishi, Jaguar, Chrysler, Polestar, and Lucid dealers did so less than 45% of the time.

- Offered an Appointment: Infiniti, Subaru, and BMW dealers set specific appointment times more than 45% of the time, whereas Chrysler, Lexus, Jaguar, Alfa Romeo, Polestar, and Lucid dealerships did so less than 25% of the time.

- Fast, Multi-Channel Response: Subaru, Infiniti, Ford, and Honda dealers both emailed or texted an answer and called the customer within 15 minutes more than 30% of the time, compared to less than 15% for Jaguar, Porsche, Polestar, and Lucid.

- Failed to Respond at All: Toyota, Infiniti, Volvo, Subaru, BMW, Porsche, and Audi had the lowest rates of failure, with fewer than 10% of inquiries receiving no personal response. In contrast, more than 25% of customers contacting Mercedes-Benz, Buick, Jaguar, Lucid, and Polestar dealerships never received a reply.

The Future of Digital Engagement in Auto Sales

“We all agree that customers today visit dealer websites first, and how dealers respond to those customers drives today’s sales success,” said O’Hagan. “The trouble is that website customers can be invisible in day-to-day operations, making them too easy to overlook.”

Pied Piper’s research underscores the importance of transparency in dealership operations. By revealing what potential buyers actually experience online, dealers can better understand their digital shortcomings and take action to improve responsiveness. The brands that continue to refine their communication strategies will be best positioned to succeed in an auto industry that is increasingly shaped by digital engagement.