“In 2023, gains in vehicle availability and pricing raised satisfaction from the low points of 2022, and that positive momentum continues this year,” commented Stewart Stropp, vice president of automotive retail at J.D. Power. “With a broader selection, more competitive pricing emerges. Yet, satisfaction with other aspects of the sales journey has not advanced at the same rate, indicating further opportunities to refine the path to purchase.”

### Key Findings of the 2024 Study

– **Decrease in Above-MSRP Pricing**: With dealerships regaining inventory, fewer buyers are paying above the Manufacturer’s Suggested Retail Price (MSRP). Only 8% of mass-market buyers and 6% of premium buyers paid over MSRP this year, down from 15% and 10% respectively in 2023.

– **Importance of Performance Metrics**: The study found a direct link between customer satisfaction and the extent to which dealerships met specific Key Performance Indicators (KPIs). Satisfaction averaged 917 when nine or 10 KPIs were fulfilled, compared to 827 when only seven or eight were met—a 90-point difference. Notable KPIs include understanding customer needs, vehicle condition upon delivery, and staff technology skills.

BEV Buyers Less Satisfied Than ICE Buyers

Satisfaction gaps between buyers of Battery Electric Vehicles (BEVs) and Internal Combustion Engine (ICE) vehicles are narrowing but persist. Mass-market ICE buyers rated their experience at 857, compared to 822 among BEV buyers. BEV buyers reported lower satisfaction with dealer staff knowledge, particularly around explaining vehicle features—a factor Tesla buyers noted acutely.

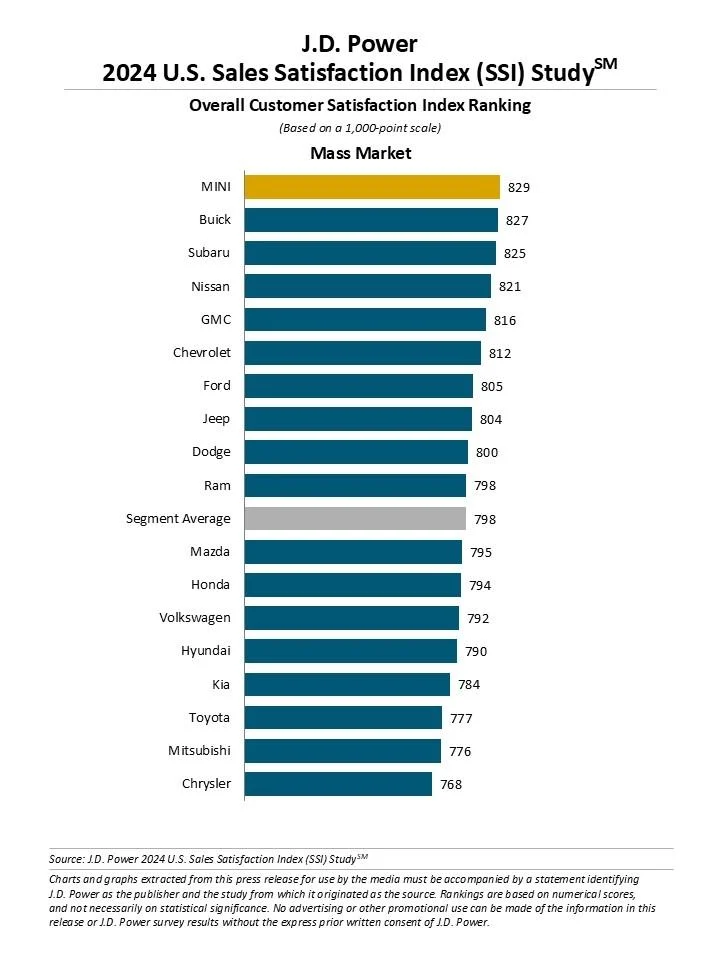

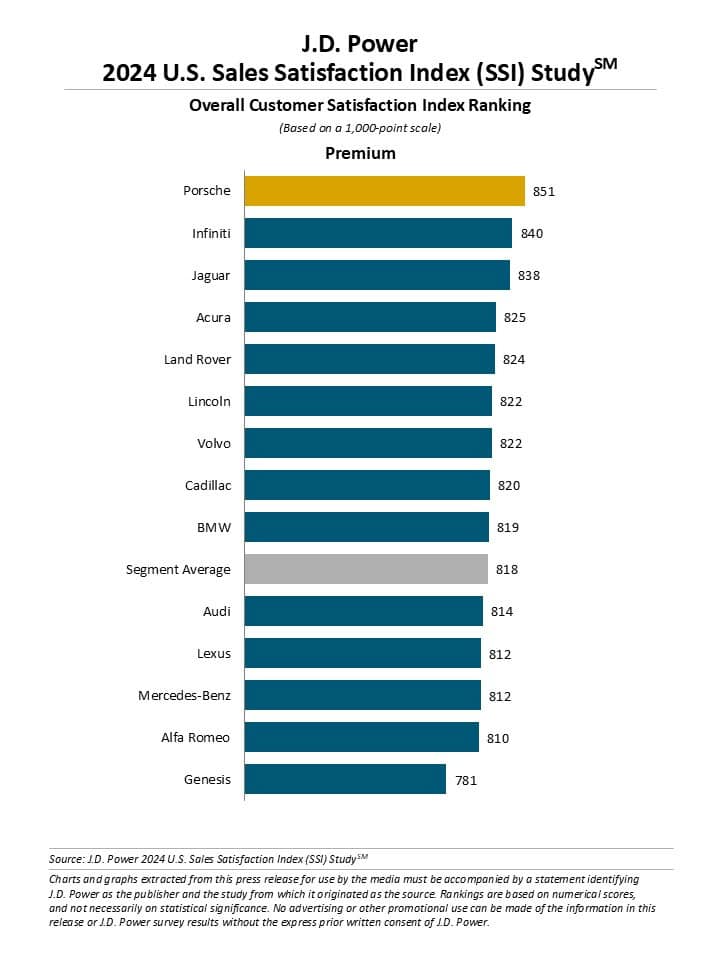

Brand Rankings

Porsche maintained the top spot among premium brands with a satisfaction score of 851, followed by Infiniti (840) and Jaguar (838). Among mass-market brands, MINI led with a score of 829, with Buick (827) and Subaru (825) following closely.

Segment Leaders

Premium Car: Porsche

Premium SUV: Porsche

Mass Market Car: Nissan

Mass Market SUV/Minivan: Buick

Mass Market Truck: GMC

Now in its 39th year, the SSI Study assesses the satisfaction of both buyers and “rejecters”—those who shop at a dealership but ultimately purchase elsewhere. The study, based on feedback from 34,596 buyers, evaluates six primary factors: the delivery process, dealership personnel, deal negotiations, paperwork, facility, and dealership website. The 2024 study was conducted from July through September among customers who purchased or leased between March and May 2024, providing a detailed snapshot of today’s vehicle buying experience.