“Amid ongoing inventory shortages, the most loyal customers actually stayed out of the market if they were unable to get their desired vehicle,” said Tyson Jominy, vice president of data & analytics at J.D. Power. “Now that inventory levels are recovering, customers are coming back. In particular, Toyota and Honda are benefitting from increased availability of hybrid vehicles, with Honda owners swapping out their gas-powered vehicles for hybrids at nearly triple the rate of the industry average. Lexus is also benefitting from strengthened residual values, which are helping drive loyalty for the brand despite premium brands as a whole experiencing a plateau this year.”

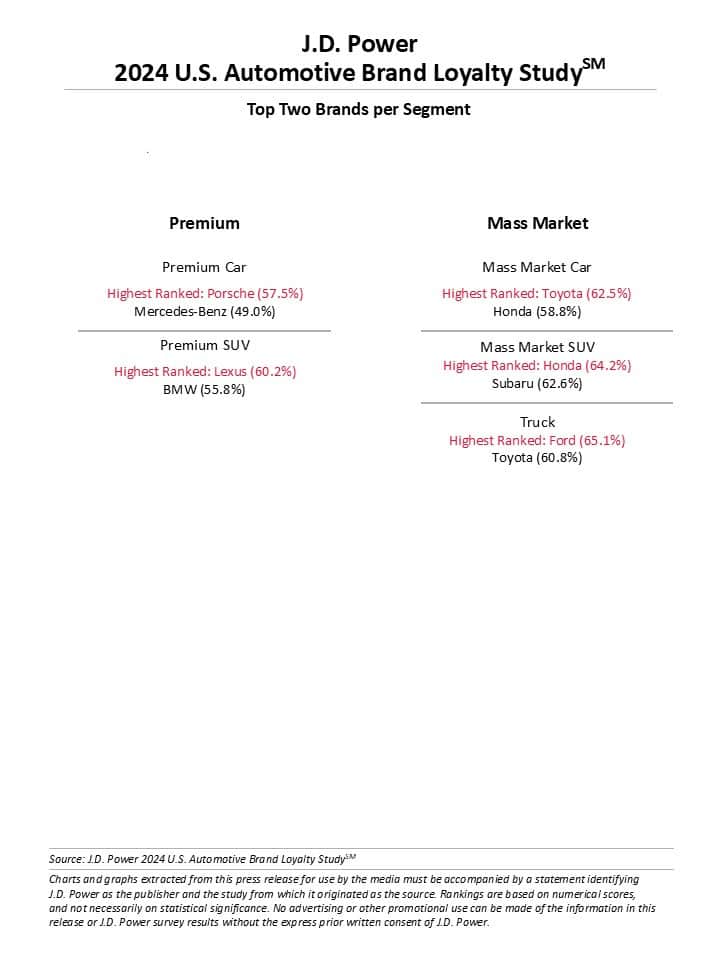

Highest-Ranking Brands

Porsche ranks highest among premium brand car owners for a third consecutive year, with a 57.5% loyalty rate. Mercedes-Benz (49.0%) ranks second.

Lexus ranks highest among premium brand SUV owners with a 60.2% loyalty rate. BMW (55.8%) ranks second.

Toyota ranks highest among mass market brand car owners for a third consecutive year, with a 62.5% loyalty rate. Honda (58.8%) ranks second.

Honda ranks highest among mass market brand SUV owners with a 64.2% loyalty rate. Subaru (62.6%) ranks second.

Ford ranks highest among truck owners for a third consecutive year, with a 65.1% loyalty rate—the highest loyalty rate in the study. Toyota (60.8%) ranks second.

The study, now in its sixth year, uses data from the Power Information Network to calculate whether an owner purchased the same brand after trading in an existing vehicle on a new vehicle. Customer loyalty is based on the percentage of vehicle owners who choose the same brand when trading in or purchasing their next vehicle. Only sales at new-vehicle franchised dealers qualify. The study includes brand loyalty across five segments: premium car; premium SUV; mass market car; mass market SUV; and truck.

The 2024 study calculations are based on transaction data from September 2023 through August 2024 and include all model years traded in.

About J.D. Power

J.D. Power is a global leader in automotive data and analytics, and provides industry intelligence, consumer insights and advisory solutions to the automotive industry and selected non-automotive industries. J.D. Power leverages its extensive proprietary datasets and software capabilities combined with advanced analytics and artificial intelligence tools to help its clients optimize business performance.