Are vehicle owners becoming overwhelmed with technology features that don’t solve a problem, don’t work, are difficult to use or are just too limited in functionality? The results of the J.D. Power 2024 U.S. Tech Experience Index (TXI) Study,SM released today, suggest that could be the case. The study, which focuses on the user experience with advanced vehicle technologies as they come to market, finds that while owners offer praise for some advanced features, others are found to be lackluster.

Are vehicle owners becoming overwhelmed with technology features that don’t solve a problem, don’t work, are difficult to use or are just too limited in functionality? The results of the J.D. Power 2024 U.S. Tech Experience Index (TXI) Study,SM released today, suggest that could be the case. The study, which focuses on the user experience with advanced vehicle technologies as they come to market, finds that while owners offer praise for some advanced features, others are found to be lackluster.

“A strong advanced tech strategy is crucial for all vehicle manufacturers, and many innovative technologies are answering customer needs”

New Artificial Intelligence (AI)-based technologies, like smart climate control, have quickly won popularity with those owners who have used it, yet recognition technologies such as facial recognition, fingerprint reader and interior gesture controls fall out of favor as they unsuccessfully try to solve a problem that owners didn’t know they had. For example, not only do owners say that interior gesture controls can be problematic (43.4 problems per 100 vehicles), but 21% of these owners also say this technology lacks functionality, according to newly added diagnostic questions in this year’s study. These performance metrics, including a lack of perceived usefulness, result in this technology being considered a lost value for any automaker that has invested millions of dollars to bring it to market.

To assist in solving this problem, J.D. Power has developed a return on investment (ROI) analysis as part of the TXI findings to use advanced data science to cluster individual technologies into three categories. The categorization of technologies—must have, nice to have and not necessary—provide automakers the ability to better align their contenting strategy with customer expectations.

“A strong advanced tech strategy is crucial for all vehicle manufacturers, and many innovative technologies are answering customer needs,” said Kathleen Rizk, senior director of user experience benchmarking and technology at J.D. Power. “At the same time, this year’s study makes it clear that owners find some technologies of little use and/or are continually annoying. J.D. Power’s ability to calculate the return on investment for individual technologies is a major step in enabling carmakers to determine the technologies that deserve the most attention while helping them ease escalating costs for new vehicles.”

Following are some of the key findings of the 2024 study:

- Drivers still prefer hands-on tech—hands down: Despite the increasing availability of advanced driver assistance systems (ADAS), many owners remain indifferent to their value. Most owners appreciate features that directly address specific concerns, such as visual blind spots while backing up. However, other ADAS features often fall short, with owners feeling capable of handling tasks without them. This is particularly evident with active driving assistance, as the hands-on-the-wheel version ranks among the lowest-rated ADAS technologies with a low perceived usefulness score (7.61 on a 10-point scale). The hands-free, more advanced version of this tech does not significantly change the user experience as indicated by a usefulness score of 7.98, which can be attributed to the feature not solving a known problem.

- Owners don’t see value in passenger screens: Automakers are expanding their offering of vehicles containing a passenger display screen despite the feature being classified as “not necessary” by vehicle owners. The tech is negatively reviewed by many owners who point to usability issues. Perhaps the technology would be viewed more favorably if the front passenger seat was used more frequently, but only 10% of vehicles carry front-seat passengers daily. Furthermore, the addition of a second screen adds to the complexity of the vehicle delivery process as it is difficult for dealers to teach new owners how to use the primary infotainment screen, let alone a second one.

- Tesla might be losing its tech edge: Historically, Tesla owners have expressed enthusiasm for the brand’s technology and rated their vehicles highly, often overlooking quality concerns. However, as Tesla’s customer base expands beyond tech-hungry early adopters, this trend is waning as this year’s results show a shift to lower satisfaction across some problematic techs such as direct driver monitoring (score of 7.65).

Highest-Ranking Brands

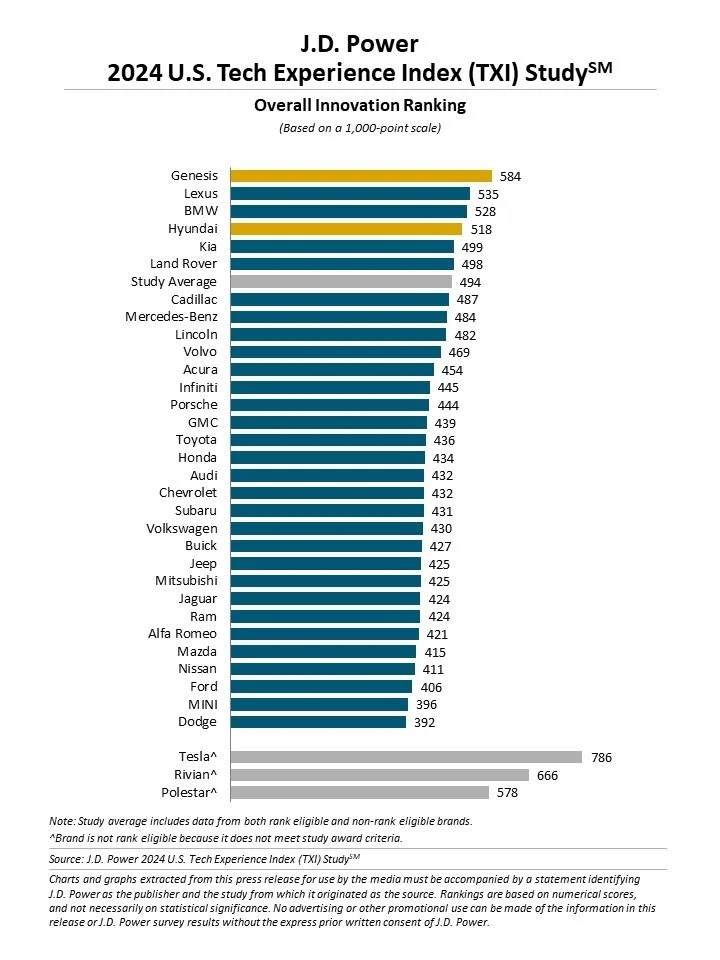

Genesis ranks highest overall and highest among premium brands for innovation for a fourth consecutive year, with a score of 584 (on a 1,000-point scale). In the premium segment, Lexus (535) ranks second and BMW (528) ranks third.

Hyundai ranks highest among mass market brands for innovation for a fifth consecutive year, with a score of 518. Kia (499) ranks second and GMC (439) ranks third.

Advanced Technology Award Recipients

The U.S. Tech Experience Index (TXI) Study analyzes 40 automotive technologies, which are divided into four categories: convenience; emerging automation; energy and sustainability; and infotainment and connectivity. Only the 31 technologies classified as advanced are award eligible.

- Toyota Sequoia is the mass market model receiving the convenience award for its camera rear-view mirror technology. The premium segment in this category is not award eligible.

- Genesis GV70 is the premium model receiving the emerging automation award for front cross traffic warning. Kia Carnival is the mass market model receiving the emerging automation award, also for front cross traffic warning.

- BMW iX receives the award for energy and sustainability in the premium segment for one-pedal driving. The mass market segment in the energy and sustainability category is not award eligible.

- BMW X6 receives the award for infotainment and connectivity in the premium segment for phone-based digital key. Hyundai Santa Fe receives the award for infotainment and connectivity in the mass market segment, also for phone-based digital key.

The 2024 U.S. Tech Experience Index (TXI) Study is based on responses from 81,926 owners of new 2024 model-year vehicles who were surveyed after 90 days of ownership. The study was fielded from July 2023 through May 2024 based on vehicles registered from April 2023 through February 2024.

The U.S. Tech Experience Index (TXI) Study complements the annual J.D. Power U.S. Initial Quality Study SM (IQS) and the J.D. Power U.S. Automotive Performance, Execution and Layout (APEAL) Study SM by measuring how effectively each automotive brand brings new technologies to market. The U.S. Tech Experience Index (TXI) Study combines the level of adoption of new technologies for each brand with excellence in execution. The execution measurement examines how much owners like the technologies and how many problems they experience while using them.