Pied Piper submitted mystery-shopper customer inquiries through the individual websites of 3,957 dealerships, asking a specific question about a vehicle in inventory, and providing a customer name, email address and local telephone number. Pied Piper then evaluated how the dealerships responded by email, telephone, and text message over the next 24 hours.

I

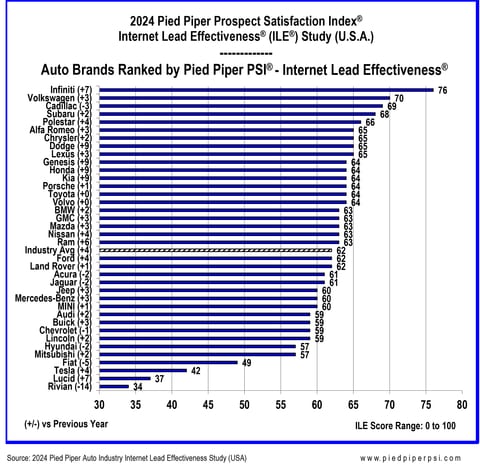

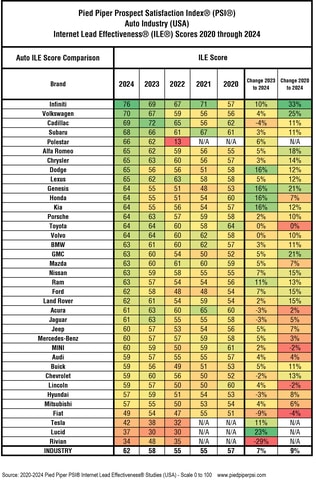

Brands with the greatest improvement were Dodge, Genesis, Honda, Kia, and Infiniti, all of whom improved their scores more than six points since last year’s study. The performance of seven brands declined: Chevrolet, Acura, Hyundai, Jaguar, Cadillac, Fiat, and Rivian. Industry average performance increased four points to a score of 62, the highest average score measured during the fourteen years Pied Piper has tracked dealer response to website customer inquiries.

Dealerships this year were more likely to respond to online customer inquiries by phone call or text message than in previous years. Not all measurements improved over last year, including the rate of answering a web customer’s question by email, which remained flat compared to last year. However, the quality of emails sent improved year over year. In their emails, dealerships were more likely to attempt to set an appointment, to provide additional information, or to suggest next steps. In addition, compared to last year’s measurements, dealerships this year were more likely to reach out to their customers by both email and phone, or by both text message and phone. “Top performing dealerships reach out to a customer using multiple paths, then when the customer responds, they follow-up using the same path chosen by the customer,” said Fran O’Hagan, Pied Piper’s CEO, “Otherwise too many customers are missed since they don’t see emails or texts, or don’t answer phone calls.”

Infiniti, this year’s top scoring automotive brand, improved their ILE score by seven points over the previous year to achieve the highest average ILE score for an automotive brand measured to date, with a score of 76. Compared to last year, Infiniti mirrored similar improvements seen industry wide but with wider margins of improvement and higher overall rates of executing positive behaviors. Leading their improvement was an increase in the rate of responding by phone call to website customers, which Infiniti dealerships increased from 50% of the time on average last year to 82% of the time this year.

Response to customer web inquiries varied by brand and dealership, and the following are examples of performance variation by brand:

- How often did the brand’s dealerships email an answer to a website customer’s inquiry?

- More than 65% of the time on average: Polestar, Infiniti, Porsche

- Less than 45% of the time on average: Buick, Ford, Tesla, Lucid

- How often did the brand’s dealerships text an answer to a website customer’s inquiry?

- More than 40% of the time on average: Volkswagen, Land Rover, Mercedes-Benz, Alpha Romeo, Jeep, Nissan, Ram

- Less than 10% of the time on average: Tesla, Polestar, Fiat, Lucid, Rivian

- How often did the brand’s dealerships respond by phone call to a website customer’s inquiry?

- More than 75% of the time on average: Infiniti, Genesis, Ford, Honda, Subaru

- Less than 50% of the time on average: Tesla, Fiat, Lucid, Rivian

- “Did both” – How often did the brand’s dealerships email or text an answer to a website customer’s question and also respond by phone call?

- More than 60% of the time on average: Infiniti, Volkswagen, Volvo

- Less than 35% of the time on average: Mitsubishi, Fiat, Tesla, Lucid, Rivian

“2024 is a more challenging business environment for car dealers,” said O’Hagan, “and many have responded by improving their interaction with online customers.” Pied Piper has found that the key to driving improvement in website response and in turn higher sales is showing dealers what their website customers are really experiencing – which is often a surprise.

Pied Piper PSI® Internet Lead Effectiveness® (ILE®) Studies have been conducted annually since 2011. The 2024 Pied Piper PSI® ILE® Automotive Industry Study was conducted between October 2023 and January 2024 by submitting personal website inquiries directly to a sample of 3,957 dealerships nationwide representing all major automotive brands.

About Pied Piper Management Company, LLC

Founded in 2003, Pied Piper Management Company, LLC is a Monterey, California, company that helps brands improve the omnichannel sales & service performance of their retailers, by establishing fact-based best practices, then measuring and reporting performance. Examples of other recent Pied Piper PSI studies are the 2023 Pied Piper PSI® ILE® Auto Dealer Group Industry Study (Napleton Auto Group was ranked first), and the 2023 Pied Piper Service Telephone Effectiveness® (STE®) Auto Dealer Group Industry Study (Group 1 Automotive was ranked first). Complete Pied Piper PSI® industry study results are provided to vehicle manufacturers and national dealer groups. Manufacturers, national dealer groups and individual dealerships also order PSI® evaluations – in-person, internet or telephone – as tools to measure and improve the omnichannel sales and service effectiveness of their dealerships. For more information about the Pied Piper Prospect Satisfaction Index, and the fact-based PSI® process, go to www.piedpiperpsi.com.