Conducted with over 2,000 consumers, the study reveals that the next wave of consumers considering an EV or hybrid are more budget conscious. Yet GBK found that potential EV buyers are willing to pay on average $7,650 more for an EV compared to a gasoline-powered vehicle with similar features.

“Contrary to the stagnant EV market depicted by some industry watchers, our study indicates the next wave of adoption for hybrid and EVs is rapidly approaching,” said GBK Co-Founder Eric Bradlow, Vice Dean of Analytics and Chair of the Marketing Department at The Wharton School. “It is also clear that consumers considering an EV or hybrid are more pragmatic and cost-conscious than current EV owners. In line with this, automakers need to align their strategies and approach to meet the needs of these target customers.”

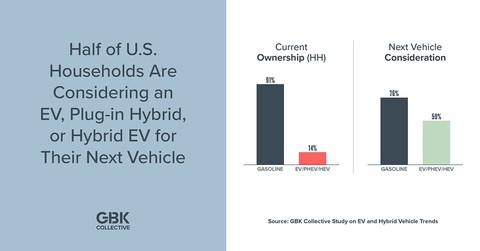

The study was co-directed by GBK and former senior automotive executive Brent Dewar, currently senior advisor at WeaveGrid, a software company that enables rapid electric vehicle adoption on the electric grid. The research also identifies essential focus areas for automotive and EV companies as they strive to attract the next wave of buyers. It sheds light on the current consumer preferences in the automotive market. While almost half of consumers (47%) remain steadfast in choosing gas-powered cars, 22% of consumers are only willing to consider an EV, PHEV, or HEV.

“The auto market is rapidly evolving, resulting in significantly increased consumer consideration for battery-powered vehicles,” said Dewar. “This presents a tremendous opportunity for automakers to create the right lineup balance between internal combustion engines (ICE), hybrids and EV’s to meet the evolving needs of these consumers today and in the coming years.”

“We believe the current climate is still favorable for automakers going aggressive on EVs, although clearly competition is growing and a more knowledgeable EV consumer is emerging,” said Dan Ives, Managing Director of Equities Research at Wedbush Securities. “While the majority of individuals have not yet purchased a clean energy vehicle, the next wave of EV prospective consumers are ready to start purchasing EV vehicles that meets all needs and preferences although this EV buying cycle will clearly be a tougher and longer evolution as it plays out in the market.”

Consumer Shift: From Early Adopters to Mainstream

Combined, the study shows that about 1 in 7 (14%) U.S. households currently own a HEV, PHEV, and EV vehicle, with just 3% owning a fully-electric vehicle. The profile of the next group of potential EV buyers in the U.S. is undergoing a significant transformation. Originally dominated by tech-savvy early adopters, primarily urbanites gravitating towards innovative, style-centric brands like Tesla, a broad swath of more mainstream U.S. households are now buying or considering EVs, PHEVs, and HEVs.

According to GBK’s study, consumers considering a new EV or hybrid are more attracted by perceived environmental benefits than current EV owners (40% vs 56%). But environmental consciousness is tempered by their evaluation of total cost of ownership, with HEV considerers indicating lower operating cost per mile (67%), lower maintenance costs (55%), and the availability of tax incentives or rebates (47%) among their top reasons for considering purchasing or leasing an electric powered vehicle.

Moreover, there’s a notable shift in vehicle preferences among EV and hybrid considerers, with an even stronger preference for SUVs, as well as neutral color palettes in line with mainstream tastes. And while pureplay EV companies and auto brands continue to introduce new models at lower price points to attract more of these buyers, EV and hybrid considerers remain concerned about ongoing costs and hassles such as battery replacement, availability of charging infrastructure, vehicle range, and the time it takes to charge.

“What we are witnessing is a classic technology adoption curve,” said GBK President and former Microsoft executive Jeremy Korst. “The next wave of potential electric-powered vehicle buyers are much more mainstream and pragmatic. They aren’t looking to buy an EV just to have an EV – it needs to fit the needs of their ongoing budget and lifestyle needs. While they are open to this new technology, they have a more discerning perspective on total cost of ownership and their anticipated end-to-end experience over the vehicle’s lifecycle.”

The Road Ahead

In the race to lead the EV market, consumer preference is becoming increasingly varied. GBK’s latest study shows that while Toyota and Tesla are the clear frontrunners among those considering battery-powered vehicles, broader market leaders – Ford, Honda, and GM – are all well-positioned to capitalize on future EV and hybrid growth. Most of the new electric-only market entrants are still struggling to gain consumer mindshare.

“As automotive brands strive to attract the next wave of EV buyers, understanding how price, features, experience and other factors influence evolving consumer decisions is paramount,” said Dewar. “This set of complex strategic questions is a perfect match for GBK’s strategic insights and advanced analytics capabilities. Their deep experience applying advanced, rigorous methods in dynamic technology markets gives them invaluable insights into the rapidly evolving automotive market.”

“There’s a clear narrative emerging from our data: consumers are ready for EVs or hybrids if the price and feature set are right,” notes Bradlow. “As we all know, it’s not just up-front price. Just like many of the other emerging technologies we are engaged with, there’s a lot more complexity to ensure the automakers are delivering the right portfolio or products to the market. GBK’s strategic research and analytics practice continues to grow, with expertise providing automakers and EV brands with actionable insights to make much better decisions to meet the evolving needs of target customers.”

Read full report.