“Most dealers had less inventory in 2021, but dealer treatment of sales prospects was still critical, as it determines not only sales today but also the dealership’s success tomorrow,” said Fran O’Hagan, CEO of Pied Piper. “Dealers who respond quickly, personally, and completely to website customer inquiries on average sell 50% more vehicles to the same quantity of website customers as opposed to dealers who fail to respond.”

Pied Piper submitted mystery-shopper customer inquiries through the individual websites of 3,628 dealerships, asking a specific question about a vehicle in inventory, and providing a customer name, email address and local telephone number. Pied Piper then evaluated how the dealerships responded by email, telephone and text message over the next 24 hours.

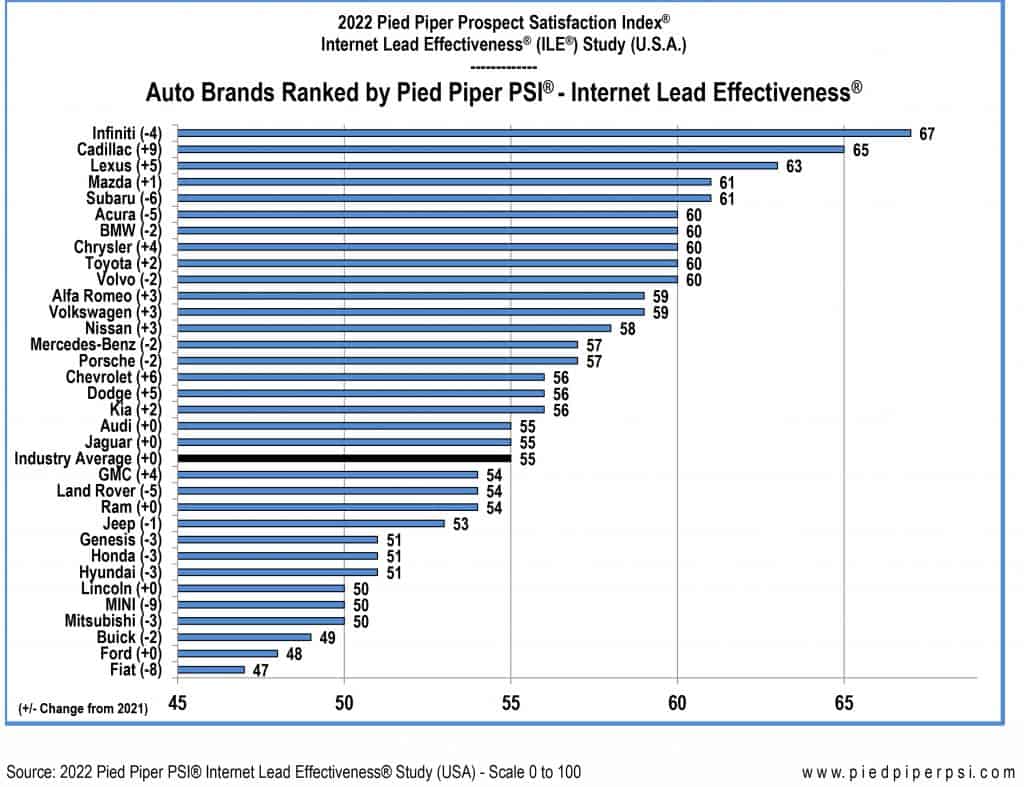

Brands with the greatest improvement since last year’s study were Cadillac, Chevrolet, Lexus, Dodge, Chrysler and GMC. Twelve brands improved their performance from 2021 to 2022, while the performance for fifteen brands declined. Industry average performance was unchanged.

However, since the start of COVID in early 2020, the most improved dealers in responding to customer queries have represented Infiniti, Lexus, Chevrolet, and Alfa Romeo. The largest declines in responsiveness for the period have been from Mini, Lincoln, Ford, and Honda dealers.

Twenty different measurements generate dealership ILE scores, on a scale of 100. In a traditional bell curve of performance, 26% of all auto dealerships nationwide scored above 80 (providing a quick and thorough personal response), while 35% of dealerships scored below 40 (failing to personally respond to their website customers).

Notable industrywide trends in behavior over the past year include the following:

- Dealerships still most often respond to customer website inquiries by phone, but that is trending downward. For the 2022 study, dealers responded by phone 57% of the time, compared to 66% last year and 70% the previous year.

- Responding via email is on the rise. Dealerships were more likely to email an answer to a website customer’s inquiry – 53% of the time, compared to 42% last year and 41% the previous year.

- Dealers also are increasingly likely to text answers to specific customer questions, instead of or in addition to emails – 14% of the time, compared to 6% last year and 2% the previous year.

- Customer spam filters are a dealership’s enemy. Emails landing in a customer’s junk mail folder happened more than 25% of the time from Alfa Romeo, Fiat, and Mitsubishi dealers. Dealers representing brands that fared the best in avoiding spam filters: Porsche, Jaguar, Land Rover, Volkswagen, Ford, and Volvo.

Response to customer web inquiries varied by brand and dealership, and the following are examples of performance variation by brand:

- How often did the brand’s dealerships email or text an answer to a website customer’s question within 30 minutes?

- More than 50% of the time on average: Infiniti, Lexus, Chrysler, Subaru, Alfa Romeo, Cadillac

- Less than 30% of the time on average: Fiat, Buick, Lincoln

- How often did the brand’s dealerships use a text message to answer a website customer’s inquiry?

- More than 20% of the time on average: Chrysler, Genesis, Mazda, Ram, Audi, Nissan

- Less than 10% of the time on average: BMW, Fiat, GMC, Land Rover, Lexus, Buick, Jaguar

- How often did the brand’s dealerships respond by phone to a website customer’s inquiry?

- More than 65% of the time on average: Subaru, Acura, Lexus, Lincoln, Mazda

- Less than 45% of the time on average: Mitsubishi, Jaguar, Buick, Fiat, Mercedes-Benz

- Although not part of ILE scoring, Pied Piper also measured dealer-website responsiveness to a site’s chat function (if offered). How often did a “human” respond to a customer question within 30 seconds?

- More than 70% of the time on average: Mitsubishi, Audi, Mercedes-Benz, Chrysler, Fiat

- Less than 50% of the time on average: Genesis, Alfa Romeo, Infiniti, Ford, Kia, Jaguar, Nissan, Toyota

The Pied Piper PSI® Internet Lead Effectiveness® (ILE®) Studies have been conducted annually since 2011. The 2022 Pied Piper PSI-ILE Study (U.S.A. Auto) was conducted between July 2021 and January 2022 by submitting website inquiries directly to a sample of 3,628 dealerships nationwide representing all major automotive brands.

About Pied Piper Management Company, LLC

Founded in 2003, Pied Piper Management Company, LLC is a Monterey, California, company that helps brands improve the omnichannel performance of their retail networks. Examples of other recent Pied Piper PSI studies are the 2021 PSI-ILE U.S. Motorcycle/UTV Industry Study (Harley-Davidson brand was ranked first), and the 2021 Omnichannel PSI for EVs Industry Study (Dealers selling the Chrysler Town & Country PHEV were ranked first.) Complete Pied Piper PSI industry study results are provided to vehicle manufacturers and national dealer groups. Manufacturers, national dealer groups and individual dealerships also order PSI evaluations—in-person, internet or telephone—as tools to measure and improve the omnichannel sales effectiveness of their dealerships. For more information about the Pied Piper Prospect Satisfaction Index, and the fact-based PSI process, go to www.piedpiperpsi.com.