Vehicle ownership (buy/lease) is more important than ever, according to the Cox Automotive 2021 Evolution of Mobility Study. This is a dramatic shift from Cox Automotive’s research in 2018, which signaled that consumer acceptance of alternative shared mobility solutions would begin to supplement traditional vehicle ownership if costs and accessibility of ride-hailing, car-sharing and subscription services were comparable. While ownership will continue to reign for now, consumers still plan to use different transportation methods as their secondary mode of getting from Point A to Point B. Moreover, a post-pandemic bounce-back is expected according to the study, with consumers surveyed still eager to embrace alternative ownership in the future.

The automotive industry is led by consumer transportation decision-making that is ever-changing,” said Ally Casey, senior manager of research & market intelligence, Cox Automotive Mobility. “In the current pandemic world, it’s no surprise that cost, safety and convenience are the key themes that surfaced in our latest Evolution of Mobility Study readout. Nevertheless, regardless of current driving habits and preferences, the future is bright for emerging mobility technology.”

Traditional Ownership Holds Steady

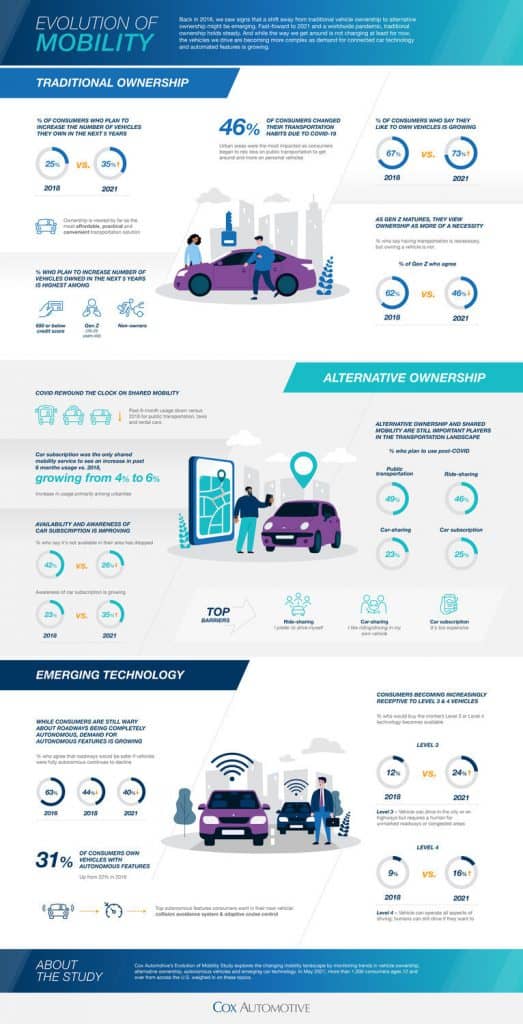

With COVID-19 at the forefront of everyone’s minds, 46% of consumers surveyed changed their transportation habits during the pandemic, halting their use of public transportation and ride-hailing services and preferring to drive their own vehicle – 78% in 2021 versus 67% in 2018. Even with average new-vehicle transaction prices hitting monthly records with Kelley Blue Book reporting August 2021 at $43,355, the perception that vehicle ownership is affordable increased to 60% in 2021, which represents a 3-percentage point increase over 2018. This also is likely the result of the average cost of a ride-hail climbing 49.5% over the first half of 2021 compared to the first half of 2019.

Despite more than one-third (38%) of consumers being open to transportation alternatives, traditional vehicle ownership is still viewed as the most convenient (78%), practical (78%) and flexible (58%) option for day-to-day personal transportation needs when compared to ride-hailing, car-sharing and subscription services. In fact, a growing percentage (35%) of Americans plan to increase the number of vehicles they own in the next five years – from 1.2 vehicles to 1.7 vehicles per household. This increase is highest among Gen Z (64%) and non-owners (88%), who now view ownership as more of a necessity compared to those surveyed in 2018.

Tech-Savvy Consumers See Value in Car Subscription Beyond Flexibility

Typically, the consumer benefit around vehicle subscription has been about increased flexibility and minimal commitment. However, flexibility is no longer the most important factor to consumers according to those surveyed, with access to the best and newest in-vehicle technology seen as the top benefit for both car subscription users (35%) and non-users (45%).

While cost remains the top barrier for adoption, car subscription is the only shared mobility service that experienced growth in 6-month usage – 6% in 2021 versus 4% in 2018. Awareness and availability also improved over the last 3 years with the percentage of consumers who say car subscription is not available in their area dropping from 26% in 2021 versus 42% in 2018. Not everyone is hesitant to try this flexible alternative to ownership with 82% of consumers who have used car subscription in the past planning to use it again post-COVID.

Modern Vehicle Technology is Now Table Stakes

Demand remains high for modern vehicle technology, including advanced driver assistance systems (ADAS) features. In fact, 56% of consumers think the more safety features a vehicle has, the safer it is – up from 49% in 2018. This acceptance will only continue to grow as more consumers gain first-hand experience. An astounding 93% of consumers surveyed believe these ADAS features are must-haves/nice-to-haves in their next vehicle. This is also the case with connected car vehicle technology, especially with younger generations. Among Gen Z and Millennials who plan to buy/lease a vehicle, vehicle-to-infrastructure (78% and 73%) and vehicle-to-pedestrian (73% and 70%) are must-haves/nice-to-haves.

While most consumers seem to be all-in on ADAS features, hesitancy with fully autonomous or Level 5 vehicles (as classified by SAE International) remains high, with only 40% of consumers agreeing that “roadways would be safer if vehicles were fully autonomous,” which is down from 44% in 2018 and even more significantly from 63% in 2016. Consumers are however increasingly receptive to Level 3 and Level 4 autonomy in the last three years. In fact, 24% of consumers surveyed say they would buy a Level 3 vehicle the moment it becomes available, a 12-percentage point increase over 2018. Much of this growth is fueled by Gen Z with 4 in 10 consumers eager to own a Level 3 autonomous vehicle today. And, while it may be some time before Level 4 autonomy becomes widespread, Gen Z and Millennials lead the way with roughly 2 in 10 interested in these vehicles.

Tesla continues to be the brand consumers believe is leading the autonomous vehicle race, with 66% considering them the leaders, up from 55% in 2018, while the other automakers are also improving autonomous vehicle perceptions, with 33% of consumers considering them leaders, up from 29% in 2021.

“Advancement in transportation technology is fast-moving, and consumers are paying attention and adopting what’s new,” said Anshika Karamchandani, associate vice president of flexible access, Cox Automotive Mobility. “These innovative features and solutions are providing the safety assurance and convenience consumers demand, including a new wave of vehicle ownership and usage driven by Gen Z.”

Cox Automotive 2021 Evolution of Mobility Study

The 2021 Evolution of Mobility Study, which surveyed 1,250 consumers in May 2021, is a continuation of previous Cox Automotive research and market intelligence spanning the last six years, exploring the changing mobility landscape by monitoring trends in vehicle ownership, alternative transportation (ride-hailing, car-sharing and subscription services), autonomous vehicles and in-vehicle technology.