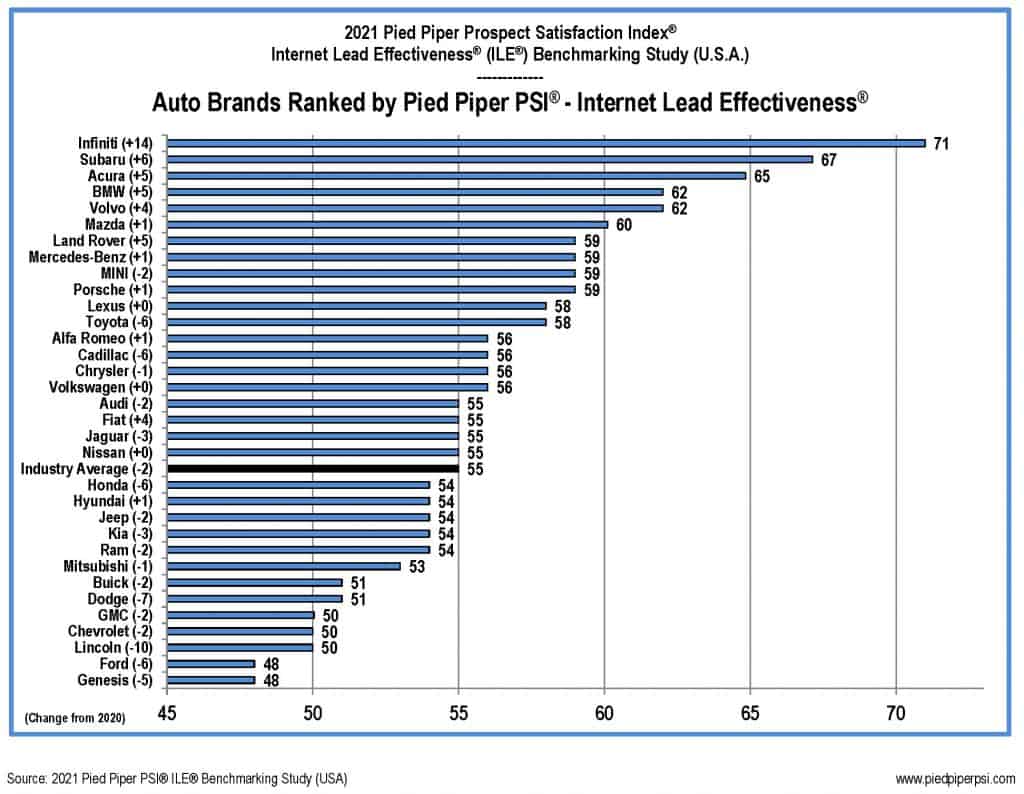

Brands with the greatest improvement from 2020 to 2021 were Infiniti, Subaru, Acura, BMW and Land Rover. Twelve brands improved their performance from 2020 to 2021, while the performance for eighteen brands, and the industry overall, declined.

Pied Piper submitted customer inquiries through the individual websites of 4,356 dealerships, asking a question about a vehicle in inventory, and providing a customer name, email address and local telephone number. Pied Piper then evaluated how the dealerships responded by email, telephone and text message over the next 24 hours.

Response to customer web inquiries varied by brand and dealership, and the following are examples of performance variation by brand:

- How often did the brand’s dealerships email or text an answer to a website customer’s question within 30 minutes?

- More than 45% of the time on average: Infiniti, Volvo, Subaru, Acura, Jaguar

- Less than 25% of the time on average: Buick, Genesis, Ford, Mitsubishi, GMC

- How often did the brand’s dealerships send a text message reply to a website customer’s inquiry?

- More than 57% of the time on average: Kia, Toyota, Nissan, Ram, Hyundai, Mitsubishi

- Less than 35% of the time on average: Mercedes-Benz, Jaguar, MINI, Porsche, Alfa Romeo

- How often did the brand’s dealership reply emails land in the customer’s junk/spam folder?

- Less than 16% of the time on average: Porsche, Lincoln, Volkswagen, Ford, Mercedes-Benz

- More than 33% of the time on average: Mitsubishi, Fiat, Kia, Genesis

Digital retail tools have become much more common on auto dealer websites, and as part of the 2021 ILE study, Pied Piper measured whether dealership websites for each brand featured the following digital retail tools:

- Did the website have a “buy now” or “buy from home” button?

- More than 40% of the websites on average: Cadillac, Buick, GMC, Genesis

- Less than 12% of the websites on average: Fiat, Porsche, Mitsubishi, Ford

- Did the website offer to provide a trade-in value?

- More than 95% of the websites on average: Ram, BMW, Kia, Chrysler, Dodge, Lincoln

- Less than 75% of the websites on average: Cadillac, Mitsubishi, GMC, Buick, Porsche

- Did the website provide a financing/payment estimator, and/or credit application?

- More than 95% of the websites on average: Ram, Dodge, Jeep, Ford, Lincoln

- Less than 82% of the websites on average: Land Rover, GMC, MINI, Porsche, Lexus

The appearance of COVID 19 has generated much more interest in digital retail tools, which allow website customers to complete more of their purchase path from home. Feedback from most dealers suggests that customers using the digital retail process still benefit from “assisted selling,” where dealership personnel are easy to reach throughout the process. However, the 2021 ILE study results show that dealers whose websites featured a “buy now” button failed to quickly respond to customer attempts to “chat” 44% of the time on average. “Digital retail technology promises to improve the car shopping experience,” said Fran O’Hagan, President & CEO of Pied Piper, “On the other hand, we can’t allow the presence of digital retail tools to excuse ignoring website customers who reach out for help.”

PSI® Internet Lead Effectiveness® (ILE®) Benchmarking Studies have been conducted annually since 2011. The 2021 Pied Piper PSI-ILE Benchmarking Study (U.S.A. Auto) was conducted between April 2020 and January 2021 by submitting website inquiries directly to a sample of 4,356 dealerships nationwide representing all major brands. Examples of other recent Pied Piper PSI studies are the 2020 PSI-ILE U.S. Motorcycle/UTV Industry Study (Harley-Davidson brand was ranked first), and the 2019 “PSI for EVs” U.S. Auto Industry Study (Tesla brand was ranked first for selling EVs in-person). Complete Pied Piper PSI industry study results are provided to vehicle manufacturers and national dealer groups. Manufacturers, national dealer groups and individual dealerships also order PSI evaluations—in-person, internet or telephone—as tools to measure and improve the omnichannel sales effectiveness of their dealerships. For more information about the Pied Piper Prospect Satisfaction Index, and the fact-based PSI process, go to www.piedpiperpsi.com.