Lucid Motors (“Lucid”), which is setting new standards for sustainable mobility with its advanced luxury EVs, and Churchill Capital Corp IV (“CCIV” or “Churchill”), a special purpose acquisition company, announced today that they have entered into a definitive merger agreement. CCIV and Lucid are combining at a transaction equity value of $11.75 billion. The transaction values Lucid at an initial pro-forma equity value of approximately $24 billion at the PIPE offer price of $15.00 per share and will provide Lucid with approximately $4.4 billion in cash (assuming no existing CCIV shares are redeemed for cash at closing).

Peter Rawlinson, CEO and CTO of Lucid, said, “Lucid is proud to be leading a new era of high-technology, high efficiency zero-emission transportation. Through a ground-up rethinking of how EVs are designed, our in-house-developed, race-proven technology and meticulous engineering have enabled industry-leading powertrain efficiency and new levels of performance. Lucid is going public to accelerate into the next phase of our growth as we work towards the launch of our new pure-electric luxury sedan, Lucid Air, in 2021 followed by our Gravity performance luxury SUV in 2023. Financing from the transaction will also be used to support expansion of our manufacturing facility in Arizona, which is the first greenfield purpose-built EV manufacturing facility in North America, and is already operational for pre-production builds of the Lucid Air. Scheduled to expand over three phases in the coming years, our Arizona facility is designed to be capable of producing approximately 365,000 units per year at scale. Lastly, this transaction further enables the realization of our vision to supply Lucid’s advanced EV technologies to third parties such as other automotive manufacturers as well as offer energy storage solutions in the residential, commercial and utility segments.”

Michael Klein, Chairman and CEO of CCIV, said, “CCIV believes that Lucid’s superior and proven technology backed by clear demand for a sustainable EV make Lucid a highly attractive investment for Churchill Capital Corp IV shareholders, many of whom have an increased focus on sustainability. We are pleased to partner with Peter and the rest of Lucid’s leadership team as it delivers the highly anticipated Lucid Air to market later this year, promising significant disruption to the EV market and creating thousands of jobs across the U.S.”

Lucid is setting new standards in performance, range and efficiency, appealing both to customers and investors committed to a zero-emission future. The company’s differentiated, proprietary EV technology, including its battery technology which is currently powering every vehicle in the world’s leading EV racing series, is underpinned by a rich portfolio of patents. Lucid’s EV technology suite was developed in-house, allowing Lucid Air to deliver outstanding efficiency with a projected range of over 500 miles on a single charge – ahead of all competitors on the market today.

Lucid’s growth will continue to benefit the communities in which it operates, particularly in California where the company is headquartered and in Arizona where the company has built its vehicle manufacturing facility from the ground up as well as its in-house EV powertrain manufacturing facility. Additionally, with directly-owned retail locations already open in California and Florida, Lucid will continue to expand its retail and service footprint across the U.S. throughout 2021. Lucid currently employs nearly 2,000 people in the U.S., and intends to continue growing quickly to support the company’s ramp in operations, with 3,000 employees expected to be added domestically by the end of 2022.

Peter Rawlinson will continue to lead Lucid along with the rest of the company’s seasoned leadership team. Churchill’s leadership team and group of operating partners will actively facilitate key introductions and relationships and provide product, design, and industry insights.

About Lucid

Headquartered in the heart of Silicon Valley in Newark, California, Lucid has benefitted enormously from California’s forward-thinking, innovation-centered business environment. Lucid’s management looks forward to continuing to operate from its California headquarters as a public company. This transaction will also support further expansion of Lucid’s direct-to-consumer retail model and Studio and Service Center locations. Currently, Lucid has 6 Studios open across the U.S. and additional sites under construction, a footprint that is scheduled to grow significantly throughout 2021. Sales expansion is planned for international markets including Europe and Middle East during 2022, and Asia Pacific thereafter.

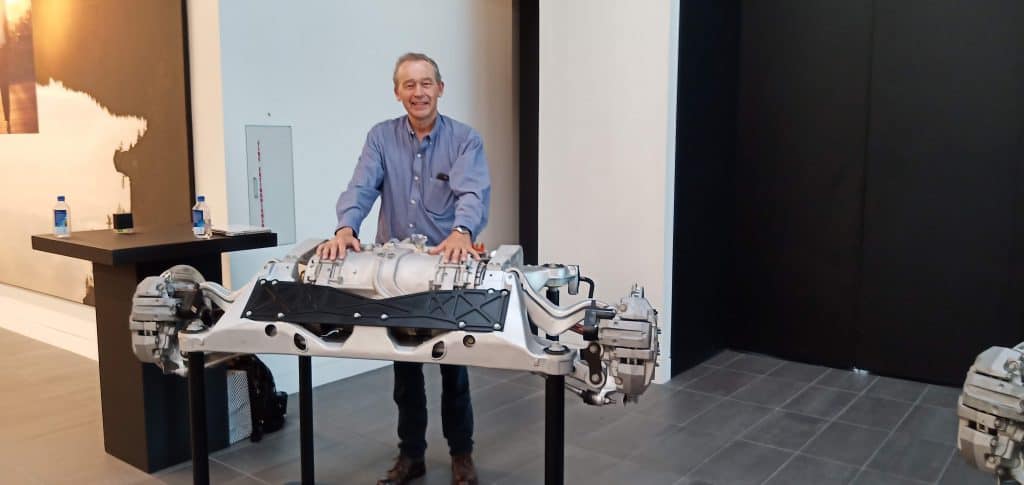

Lucid’s completed, purpose-built manufacturing facilities are production-ready and positioned for expansion. In Casa Grande, Arizona, Lucid is already manufacturing Lucid Air pre-production vehicles in a state-of-the-art facility called AMP-1 that represents the first greenfield EV manufacturing facility in North America. Just a few miles away from AMP-1 is Lucid’s powertrain manufacturing plant, LPM-1, where Lucid produces battery packs, integrated drive units and Wunderbox two-way chargers, which present significant opportunities in energy-capture technology. In addition to its in-house technological and manufacturing capabilities, Lucid has established strong relationships with core suppliers for key materials like battery cells, including a development and supply agreement with LG Chem. Currently, Lucid’s AMP-1 facility can produce 34,000 vehicles annually, but with a total of three phases of expansion planned over the coming years, the site is expected to be capable of producing approximately 365,000 vehicles per year at scale.

As a part of its vision, Lucid intends to leverage its technology portfolio and expertise in electrification to enable a broader societal transformation towards clean energy. Lucid sees compelling potential for use of its electric powertrain technology in other OEM vehicles as well as in the aerospace, heavy machinery and agricultural industries, and also recognizes adjacent opportunities for energy storage applications in the residential, commercial and utility sectors.

About Lucid Air

Lucid’s first car, the Lucid Air, is a state-of-the-art luxury sedan with a California-inspired design underpinned by race-proven technology. Featuring luxurious full-size interior in a mid-size exterior footprint, the Air will be capable of an EPA estimated range of over 500 miles and 0-60 mph in under 2.5 seconds. Customer deliveries of the Lucid Air, which will be produced at Lucid’s new factory in Casa Grande, Arizona, will accelerate in the second half of 2021 as the factory increases production. Consumers engage with Lucid through an advanced digital platform that is unique in the industry, enabling seamless digital experiences across multiple touchpoints.

Summary of the Transaction

The total investment of approximately $4.6 billion is being funded by CCIV’s approximately $2.1 billion in cash (assuming no redemptions by CCIV shareholders) and a $2.5 billion fully committed PIPE at $15.00 per share, a 50% premium to CCIV’s net asset value, anchored by the Public Investment Fund (PIF) as well as funds and accounts managed by BlackRock, Fidelity Management & Research LLC, Franklin Templeton, Neuberger Berman, Wellington Management and Winslow Capital Management, LLC.

None of Lucid’s existing investors will sell stock in the transaction and are subject to a six-month lock up for the shares they receive in the transaction. All proceeds will be used as growth capital for the company to execute on its strategic and operational initiatives. Lucid currently has no indebtedness.

The transaction includes a $2.5 billion fully committed, common stock PIPE with a unique investor lock-up provision that runs until the later of (i) September 1, 2021, and (ii) the date the PIPE shares are registered.

In connection with the transaction, Churchill’s sponsor has entered into an agreement to amend the terms of its founder equity to align with the long-term value creation and performance of Lucid. Churchill’s sponsor has agreed not to transfer its founder equity for 18 months after the closing of the transaction.

The Board of Directors of Churchill and the special transaction committee of the Board of Directors of Lucid have unanimously approved the proposed transaction.

The transaction is expected to close in Q2 2021, subject to approval by Churchill stockholders representing a majority of the outstanding Churchill voting power, Churchill having available cash at closing of at least $2.8 billion (including the $2.5 billion of committed PIPE proceeds), the expiration of the HSR Act waiting period and other customary closing conditions.

The majority shareholder of Lucid has entered into a Voting and Support Agreement to vote in favor of the transaction, which vote would be sufficient to approve the transaction for Lucid shareholders.

Investor Presentation

A copy of the investor presentation can be found by accessing the Lucid investor page.

Advisors

Citi is serving as sole financial advisor to Lucid. BofA Securities and Guggenheim Securities are serving as M&A advisors to Churchill, and Guggenheim Securities rendered a fairness opinion to Churchill in connection with the proposed transaction. BofA Securities and Citi are serving as co-placement agents and Guggenheim Securities is serving as capital markets advisor to Churchill on the PIPE. Davis Polk & Wardwell LLP is serving as legal counsel to Lucid. Weil, Gotshal & Manges LLP is serving as legal counsel to Churchill.

About Churchill Capital Corp IV

Churchill Capital Corp IV was formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of financial and operational metrics, projections of market opportunity, market share and product sales, expectations and timing related to commercial product launches, including the start of production and launch of the Lucid Air and any future products, the performance, range, autonomous driving and other features of the Lucid Air, future market opportunities, including with respect to energy storage systems and automotive partnerships, future manufacturing capabilities and facilities, future sales channels and strategies, future market launches and expansion, potential benefits of the proposed business combination and PIPE investment (collectively, the “proposed transactions”) and the potential success of Lucid’s go-to-market strategy, and expectations related to the terms and timing of the proposed transactions. These statements are based on various assumptions, whether or not identified in this press release, and on the current expectations of Lucid’s and CCIV’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Lucid and CCIV. These forward-looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business, market, financial, political and legal conditions; the inability of the parties to successfully or timely consummate the proposed transactions, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the proposed transactions or that the approval of the shareholders of CCIV or Lucid is not obtained; the outcome of any legal proceedings that may be instituted against Lucid or CCIV following announcement of the proposed transactions; failure to realize the anticipated benefits of the proposed transactions; risks relating to the uncertainty of the projected financial information with respect to Lucid, including conversion of reservations into binding orders; risks related to the timing of expected business milestones and commercial launch, including Lucid’s ability to mass produce the Lucid Air and complete the tooling of its manufacturing facility; risks related to the expansion of Lucid’s manufacturing facility and the increase of Lucid’s production capacity; risks related to future market adoption of Lucid’s offerings; the effects of competition and the pace and depth of electric vehicle adoption generally on Lucid’s future business; changes in regulatory requirements, governmental incentives and fuel and energy prices; Lucid’s ability to rapidly innovate; Lucid’s ability to deliver Environmental Protection Agency (“EPA”) estimated driving ranges that match or exceed its pre-production projected driving ranges; future changes to vehicle specifications which may impact performance, pricing, and other expectations; Lucid’s ability to enter into or maintain partnerships with original equipment manufacturers, vendors and technology providers; Lucid’s ability to effectively manage its growth and recruit and retain key employees, including its chief executive officer and executive team; Lucid’s ability to establish its brand and capture additional market share, and the risks associated with negative press or reputational harm; Lucid’s ability to manage expenses; Lucid’s ability to effectively utilize zero emission vehicle credits; the amount of redemption requests made by CCIV’s public shareholders; the ability of CCIV or the combined company to issue equity or equity-linked securities in connection with the proposed transactions or in the future; the outcome of any potential litigation, government and regulatory proceedings, investigations and inquiries; and the impact of the global COVID-19 pandemic on Lucid, CCIV, the combined company’s projected results of operations, financial performance or other financial metrics, or on any of the foregoing risks; and those factors discussed in CCIV’s final prospectus dated July 30, 2020 and the Quarterly Reports on Form 10-Q for the quarters ended July 30, 2020 and September 30, 2020, in each case, under the heading “Risk Factors,” and other documents of CCIV filed, or will file, with the SEC. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that neither Lucid nor CCIV presently know or that Lucid and CCIV currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Lucid’s and CCIV’s expectations, plans or forecasts of future events and views as of the date of this press release. Lucid and CCIV anticipate that subsequent events and developments will cause Lucid’s and CCIV’s assessments to change. However, while Lucid and CCIV may elect to update these forward-looking statements at some point in the future, Lucid and CCIV specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing Lucid’s and CCIV’s assessments as of any date subsequent to the date of this press release. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Additional Information About the Proposed Transactions and Where to Find It

The proposed transactions will be submitted to shareholders of CCIV for their consideration. CCIV intends to file a registration statement on Form S-4 (the “Registration Statement”) with the Securities and Exchange Commission (the “SEC”) which will include preliminary and definitive proxy statements to be distributed to CCIV’s shareholders in connection with CCIV’s solicitation for proxies for the vote by CCIV’s shareholders in connection with the proposed transactions and other matters as described in the Registration Statement, as well as the prospectus relating to the offer of the securities to be issued to Lucid’s shareholders in connection with the completion of the proposed business combination. After the Registration Statement has been filed and declared effective, CCIV will mail a definitive proxy statement and other relevant documents to its shareholders as of the record date established for voting on the proposed transactions. CCIV’s shareholders and other interested persons are advised to read, once available, the preliminary proxy statement/prospectus and any amendments thereto and, once available, the definitive proxy statement/prospectus, in connection with CCIV’s solicitation of proxies for its special meeting of shareholders to be held to approve, among other things, the proposed transactions, because these documents will contain important information about CCIV, Lucid and the proposed transactions. Shareholders may also obtain a copy of the preliminary or definitive proxy statement, once available, as well as other documents filed with the SEC regarding the proposed transactions and other documents filed with the SEC by CCIV, without charge, at the SEC’s website located at www.sec.gov or by directing a request to CCIV.

INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Participants in the Solicitation

CCIV, Lucid and certain of their respective directors, executive officers and other members of management and employees may, under SEC rules, be deemed to be participants in the solicitations of proxies from CCIV’s shareholders in connection with the proposed transactions. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of CCIV’s shareholders in connection with the proposed transactions will be set forth in CCIV’s proxy statement/prospectus when it is filed with the SEC. You can find more information about CCIV’s directors and executive officers in CCIV’s final prospectus filed with the SEC on July 30, 2020. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests will be included in the proxy statement/prospectus when it becomes available. Shareholders, potential investors and other interested persons should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from the sources indicated above.

No Offer or Solicitation

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.