“The race never ends to develop ‘must have’ vehicle technologies,” said Kristin Kolodge, executive director of driver interaction & human machine interface research at J.D. Power. “New technology continues to be a primary factor in the vehicle purchase decision. However, it’s critical for automakers to offer features that owners find intuitive and reliable. The user experience plays a major role in whether an owner will use the technology on a regular basis or abandon it and feel like they wasted their money.”

The study, now in its fifth year, has been redesigned for 2020 and specifically focuses on the most advanced technologies when they are first introduced in the market.

The TXI Innovation Index measures how effectively each automotive brand brings these technologies to market, measured on a 1,000-point scale. The index combines the level of adoption of new technologies for each brand with the excellence in execution. The execution measurement examines how much owners like the technologies and how many problems they experience while using them.

Following are key findings of the 2020 study:

- Sights set on creative camera views: Owners think highly of technologies that provide an “extra set of eyes” to help them drive their vehicle. Notably, owners in the luxury segment rate such technologies highest in five of the six satisfaction attributes measured in the study. Camera rear-view mirror earns the highest Execution Index score (894) among luxury owners, followed by ground view camera (884). Among advanced camera/vision technologies, camera rear-view mirror receives the highest overall execution in the mass market segment (889), followed by transparent trailer view (874) and ground view camera (858). High percentages of owners who have these three features say they “definitely will” want these features on their next vehicle (73% for camera rear-view mirror, 62% for ground view mirror and 53% for transparent trailer view).

- Giving the finger to interior gesture controls: Among luxury owners, interior gesture controls—technology that allows the user to control various features in the vehicle using hand gestures instead of touching anything—is the lowest-rated technology by far across all satisfaction attributes. (The technology isn’t yet available in the mass market segment.) Owners who have this feature on their vehicle experience a high rate of problems (36 problems per 100 vehicles), which is more than twice the rate of the next closest technology. A high proportion (61%) of these owners use the technology less than half of the time they drive, with 14% having never tried it and 16% having tried it but no longer using it.

- Many owners don’t trust technologies necessary for more automated driving: Active driving assistance is designed so that the vehicle is able to perform functions such as acceleration, braking and steering, while the driver remains engaged in the driving task. Some drivers mention the positive experience they have from using the system (e.g., lower stress and arriving at their destination more refreshed), yet this necessary step to achieve higher levels of automated driving is failing to earn the trust of most drivers who consider it to be annoying or distracting. There is wide variation in the execution strategy across brands for how the technology works and when or why it engages. Training drivers on the proper usage of such systems is imperative to eliminate misunderstanding of the technology’s capabilities and, in many cases, this training is simply not happening.

- Tesla profiled for first time: Tesla receives an Innovation Index score of 593. The automaker is not officially ranked among other brands in the study because it doesn’t meet ranking criteria. Unlike other manufacturers, Tesla doesn’t grant J.D. Power permission to survey its owners in 15 states where it is required. However, Tesla’s score was calculated based on a sample of surveys from owners in the other 35 states.

Highest-Ranking Brands

Volvo ranks highest overall with an Innovation Index score of 617 and offers a high level of advanced technologies across its entire product lineup. In the luxury segment, BMW (583) ranks second, followed by Cadillac (577), Mercedes-Benz (567) and Genesis (559).

Hyundai ranks highest in the mass market segment with a score of 556. Hyundai offers an above average level of technologies and scores well for excellence in execution. Subaru (541) ranks second, followed by Kia (538), Nissan (534) and Ram (520).

Advanced Technology Award Recipients

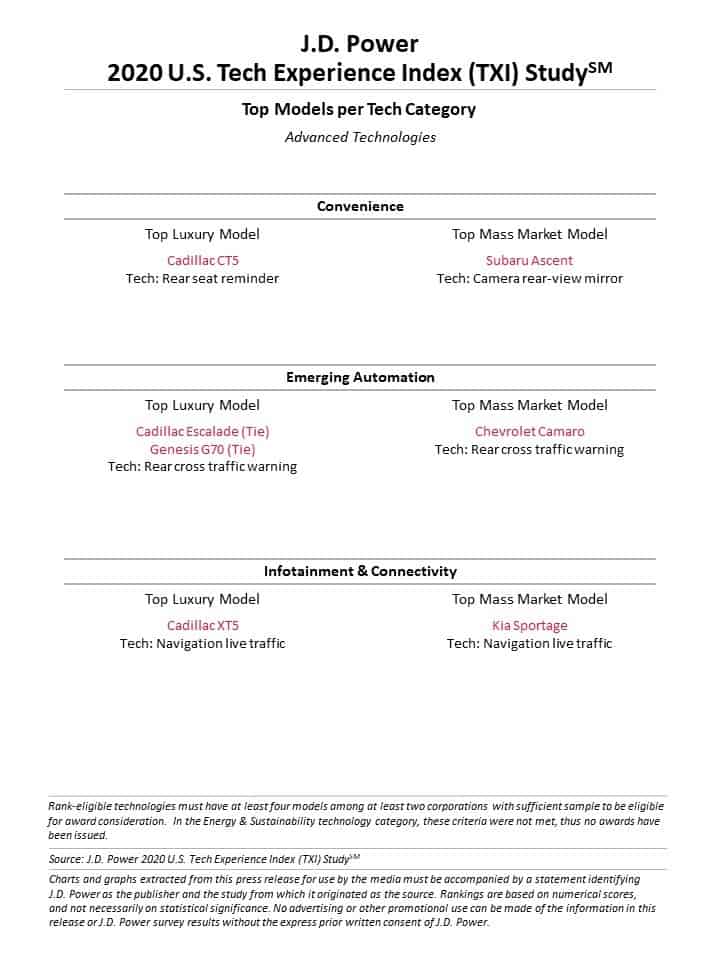

The TXI Study analyzes 34 technologies, which are divided into four categories: convenience; emerging automation; energy and sustainability; and infotainment and connectivity. Only technologies classified as advanced are award eligible.

- Cadillac CT5 is the luxury model receiving the convenience award, for rear seat reminder technology. Subaru Ascent is the mass market model receiving the convenience award, for camera rear-view mirror technology.

- Cadillac Escalade and Genesis G70 both receive the luxury model emerging automation award (in a tie), for rear cross traffic warning technology. Chevrolet Camaro is the mass market model receiving the emerging automation award, also for rear cross traffic warning technology.

- Cadillac XT5 receives the infotainment and connectivity award in the luxury segment, for navigation live traffic technology. Kia Sportage receives the infotainment and connectivity award in the mass market segment, also for navigation live traffic technology.

The 2020 U.S. Tech Experience Index (TXI) Study is based on responses from 82,527 owners of new 2020 model-year vehicles who were surveyed after 90 days of ownership. The study was fielded February through May 2020.

The study, which complements the annual J.D. Power Initial Quality Study (IQS)SM and the J.D. Power Automotive Performance, Execution and Layout (APEAL) Study,SM is used extensively by automakers and suppliers worldwide to provide an overview of how vehicle owners perceive the advanced technology features and to help the industry address any problematic areas before the technologies are made widely available across automotive portfolios, thus improving the future owner experience.