“There are many factors that contribute to brand loyalty, ranging from the experience a customer has when purchasing the vehicle to how driving it makes them feel,” said Tyson Jominy, vice president of data & analytics at J.D. Power. “Automakers are really focused on customer retention, as evidenced by the payment plans and incentives they’ve offered since the COVID-19 pandemic broke out. Many have gone above and beyond to offer customers financial assistance during a period of economic uncertainty, which does a lot to bolster consumer confidence in their chosen brand and repurchase it in the future.”

Using data from the Power Information Network, the study, now in its second year, calculates whether an owner purchased the same brand after trading in an existing vehicle on a new vehicle. Customer loyalty is based on the percentage of vehicle owners who choose the same brand when trading in or purchasing their next vehicle.

Lexus ranks highest among luxury brands for the second consecutive year with a 48% loyalty rate. Mercedes-Benz ranks second (47.8%), followed by BMW (45.1%), Porsche (44.9%) and Audi (43.4%).

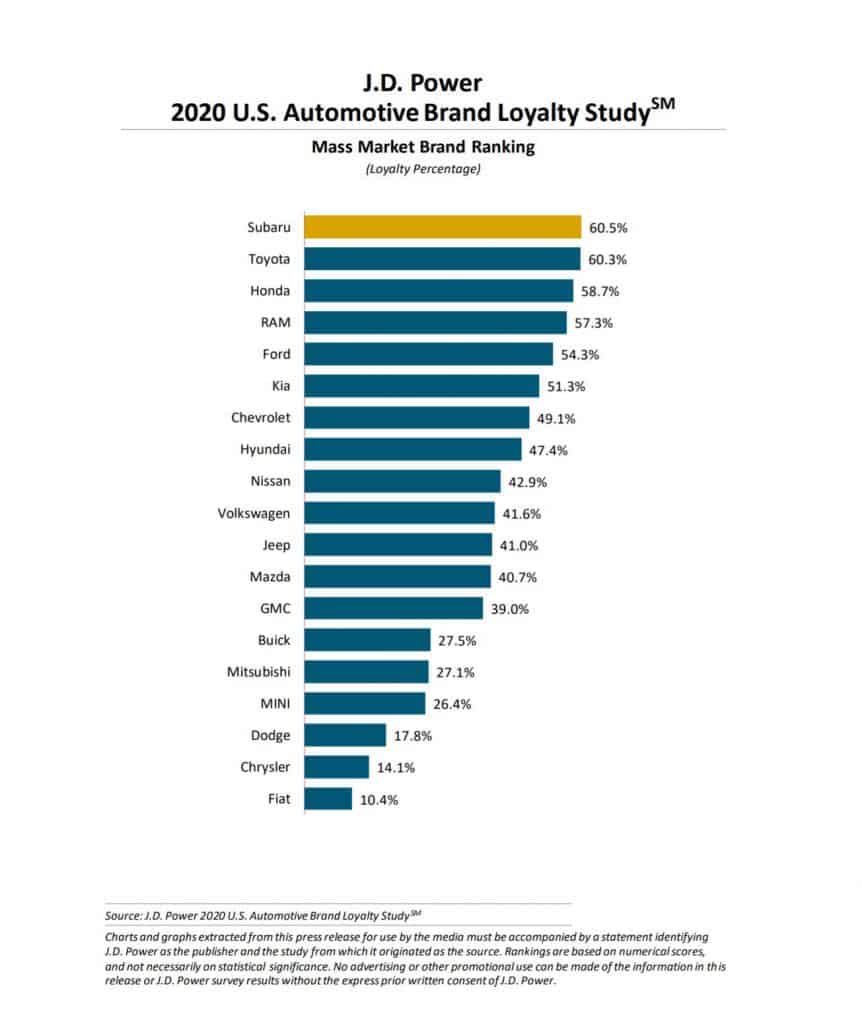

Subaru ranks highest among mass market brands and highest overall in the automotive industry for a second consecutive year with a loyalty rate of 60.5%. Toyota ranks second (60.3%), followed by Honda (58.7%), RAM (57.3%) and Ford (54.3%).

The 2020 U.S. Automotive Brand Loyalty Study calculations are based on transaction data from June 2019 through May 2020 and include all model years traded in.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power has offices serving North America, Asia Pacific and Europe.