Escalent, a top human behavior and analytics firm, published a report outlining consumer expectations of battery electric vehicles (BEVs) and their viability as replacements for traditional gasoline-powered cars, or internal combustion engine (ICE) vehicles, among buyers in the United States and Europe. The Future of BEV: How to Capture the Hearts and Minds of Consumers reveals the intent among many consumers to abandon ICE vehicles altogether, citing the improved infrastructure and range of BEVs.

Escalent, a top human behavior and analytics firm, published a report outlining consumer expectations of battery electric vehicles (BEVs) and their viability as replacements for traditional gasoline-powered cars, or internal combustion engine (ICE) vehicles, among buyers in the United States and Europe. The Future of BEV: How to Capture the Hearts and Minds of Consumers reveals the intent among many consumers to abandon ICE vehicles altogether, citing the improved infrastructure and range of BEVs.

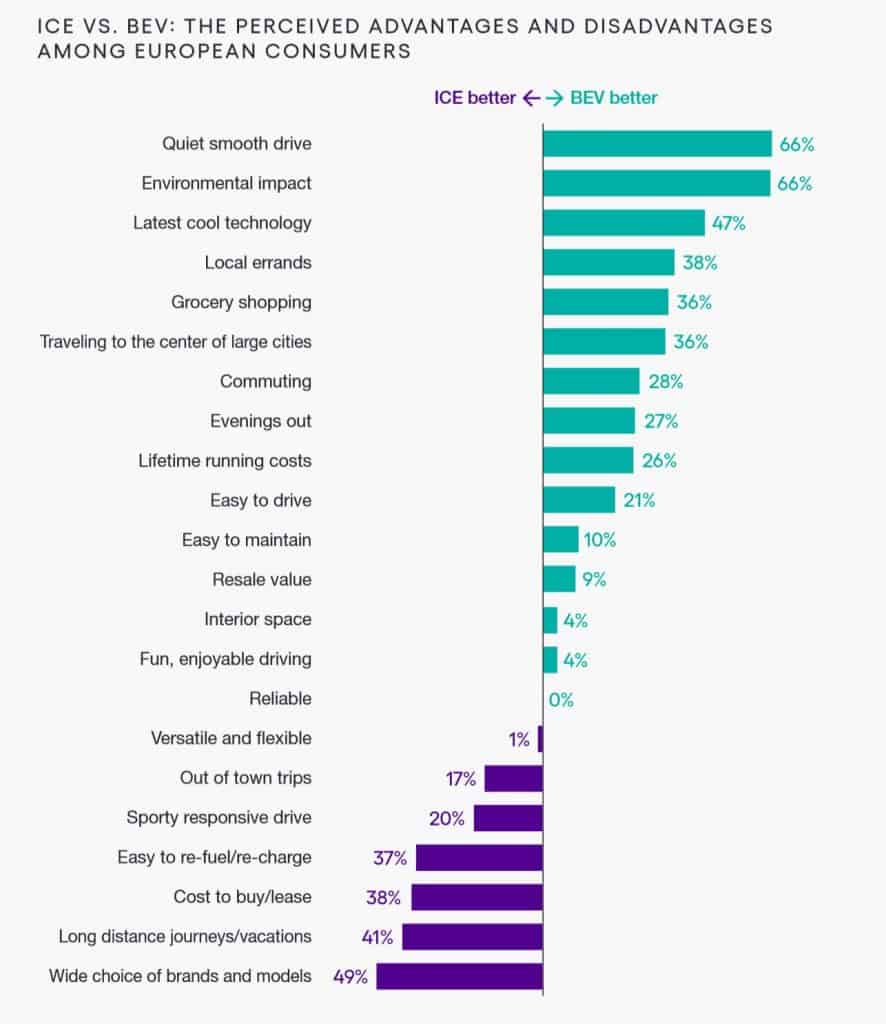

The Future of BEV gives auto and mobility manufacturers a strategic view of the benefits of their products in the eyes of consumers and highlights the areas of opportunity for automakers to push the innovation boundaries of BEVs to spur broad adoption of the technology.

“While most buyers don’t plan to choose BEVs over gasoline-powered cars within the next five years, consumers have told us there is a clear intention to take BEVs seriously in the five years that follow,” said Mark Carpenter, joint managing director of Escalent’s UK office. “However, manufacturers will need to tap into the emotional value of BEVs rather than just the rational and functional aspects to seize on that intent and inspire broader consumer adoption.”

The study demonstrates a significant shift in consumers’ expectations that BEVs will become viable alternatives to—and competitors with—ICE vehicles over the coming decade. Though 70% of Americans plan to buy a gasoline-powered car within the next year, just 37% expect to make that same purchase in five to ten years. Similarly, while 50% of European consumers favor buying vehicles powered by gasoline and diesel in the near-term, that figure drops to just 23% in five to ten years.

At the same time, consumers on both sides of the Atlantic see BEV adoption rising to 36% in Europe and 16% in the US, with respondents also indicating intent to purchase hybrids and hydrogen-powered cars.

Infrastructure clearly continues to be one of the biggest barriers to adoption. While some work is being done in Europe as well as in the US, the data show there is a significant need for some players to take ownership if manufacturers want to move the needle on BEV adoption.

US and European consumers have stark differences in opinion as to which entities they believe are primarily responsible for providing BEV charging stations. American consumers consider carmakers (45%) the primary party responsible, followed by fuel companies, local government/transport authorities, and the national government in fourth. On the other hand, European consumers view the national government (29%) as the primary party responsible for providing BEV infrastructure, followed by carmakers, local government/transport authorities and fuel companies.