Zebra, insurance search engine, released its annual State of Auto Insurance Report, which revealed that national car insurance premiums are at an all-time high – up 20% since 2011. The report, which explores insurance pricing trends over time and by individual insurance rating factor, shows extreme pricing volatility in recent years. Even though new cars has advanced anti-theft and safety technology that can reduce theft and collisions, but insurance companies offer few, if any, discounts for having these features in your car.

Zebra, insurance search engine, released its annual State of Auto Insurance Report, which revealed that national car insurance premiums are at an all-time high – up 20% since 2011. The report, which explores insurance pricing trends over time and by individual insurance rating factor, shows extreme pricing volatility in recent years. Even though new cars has advanced anti-theft and safety technology that can reduce theft and collisions, but insurance companies offer few, if any, discounts for having these features in your car.

Hurricanes may have affected rates. For example, Texas is the 6th most expensive state for car insurance, and rates are continuing to rise. The state had the 6th biggest rate hike from 2011 to now – a 44% increase.

The least expensive cars to insure are

- Honda CR-V $1,317

- Honda Odyssey $1,333

- Jeep Wrangler $1,337

- Jeep Renegade $1,342

- Jeep Patriot $1,353

- Jeep Compass $1,354

- Jeep Cherokee $1,366

- Chevy Traverse $1,366

- Nissan Frontier $1,375

- Ford Escape $1,379

The State of Auto Insurance in 2018: Expensive, Volatile, and Inconclusive About Tech

The Zebra’s annual report examines more than 52 million auto insurance rates across all U.S. zip codes to provide insight into the many factors insurance companies use to price insurance – and why that pricing is unique to every individual. Key findings reveal that the state of auto insurance in 2018 is:

- Expensive:

- Car insurance rates in the U.S. are higher than they’ve ever been, with a national average annual premium of $1,427 – a 20% increase over 2011.

- Some U.S. cities have an average annual premium of more than $6,000.

- Most expensive states for car insurance:

-

-

- Michigan

- Louisiana

- Kentucky

- Most expensive cities for car insurance:

-

-

-

- Detroit, Mich.

- New Orleans, La.

- Hialeah, Fla.

-

- Volatile:

- Car insurance rates in some states increased more than 60% over 2011 while others increased as little as 1%.

- Meanwhile, 10 states had a net rate decrease, some by as much as 20%.

- Rate changes from one year to the next were as high as 9% nationally and up to 45% in some states.

- Inconclusive about Technology:

- Insurance companies are penalizing distracted driving use for the first time since the advent of cell phones, though still not nearly as harshly as for other dangerous traffic violations, such as drunk driving. Today, getting caught texting or using your phone while driving will raise your insurance premium 16% (that’s $226) – and in some states more than 40%.

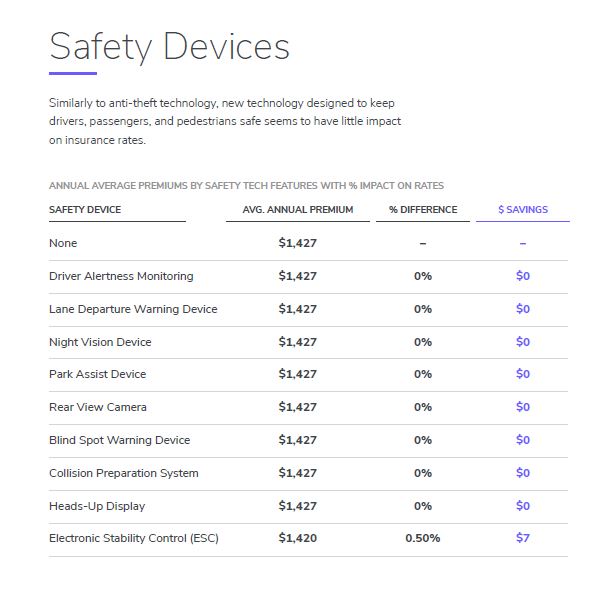

- Vehicles with advanced anti-theft and safety technology may be proven to reduce theft and collisions, but insurance companies offer few, if any, discounts for having these features in your car.

A traffic ticket can adversely affect insurance rates with increases

- 4% Not wearing seat belt21% Speeding 6-20MPH over limit40% At-fault accident77% DUI85% Hit and run

Other findings in The Zebra’s State of Auto Insurance Report offers research-based tips for saving on car insurance.