In the past few months there have been several studies about consumers, drivers, automakers, mobililty and the future of the self-driving cars, autonomous, connect vehicles. There are many reasons for this. Cities need to plan for the future. Automakers want to make more profits. Technology companies are looking for the next “iPhone”. Futurists want a better world. Consumers who are faced with the average price of car at about $35,000 are trying to find a cheaper way to get around. Traffic is getting worse, sending Wazers up mountains and through all parts of town to get to work and home. Drivers want to do something to cope with the boredom of long commutes. Studies and any trip on the road show that drivers are not looking at the road but at smartphones. This creates a perfect storm for misconnuncication, confusion and the birth of urban legends. Younger people think self-driving cars are safe, whle older people are scared. However, academic research shows that autonomous driving will not solve the world’s traffic problems becuase autonomous cars will make way more trips and cut into other public tranportation. This article is a comprehensive compliation of the latest theories and reports about self-driving autonmous connected cars and new mobility options.

In the past few months there have been several studies about consumers, drivers, automakers, mobililty and the future of the self-driving cars, autonomous, connect vehicles. There are many reasons for this. Cities need to plan for the future. Automakers want to make more profits. Technology companies are looking for the next “iPhone”. Futurists want a better world. Consumers who are faced with the average price of car at about $35,000 are trying to find a cheaper way to get around. Traffic is getting worse, sending Wazers up mountains and through all parts of town to get to work and home. Drivers want to do something to cope with the boredom of long commutes. Studies and any trip on the road show that drivers are not looking at the road but at smartphones. This creates a perfect storm for misconnuncication, confusion and the birth of urban legends. Younger people think self-driving cars are safe, whle older people are scared. However, academic research shows that autonomous driving will not solve the world’s traffic problems becuase autonomous cars will make way more trips and cut into other public tranportation. This article is a comprehensive compliation of the latest theories and reports about self-driving autonmous connected cars and new mobility options.

Let’s look at recent studies and white papers, we also need to look at who or what entity paid for the study. When

Autonomous Intel the Way to Profits, Mobility Services and Car-Venience

In study comissioned (paid for) by Intel, a company that is investing hug sums of money into autonomous technology including SoCs and advanced circutry. The explores the yet-to-be-realized economic potential when today’s drivers become idle passengers. Coined the “Passenger Economy” by Intel and prepared by analyst firm Strategy Analytics, the study predicts an explosive economic trajectory growing from $800 billion in 2035 to $7 trillion by 2050.

The report claims autonomous driving and smart city technologies will enable the new Passenger Economy, gradually reconfiguring entire industries and inventing new ones thanks to the time and cognitive surplus it will unlock. The nreport frames the value of the economic opportunity through both a consumer and business lens and begins to build use cases designed to enable decision-makers to develop actionable change strategies.

The research firm further points out that autonomously operated vehicle commercialization will gain steam by 2040 – generating an increasingly large share of the projected value and heralding the emergence of instantaneously personalized services.

Key report highlights include:

- Business use of Mobility-as-a-Service (MaaS) is expected to generate $3 trillion in revenues, or 43 percent of the total passenger economy.

- Consumer use of Mobility-as-a-Service offerings is expected to account for $3.7 trillion in revenue, or nearly 55 percent of the total passenger economy.

- $200 billion of revenue is expected to be generated from rising consumer use of new innovative applications and services that will emerge as pilotless vehicle services expand and evolve.

- Self-driving vehicles are expected to free more than 250 million hours of consumers’ commuting time per year in the most congested cities in the world.

- Reductions in public safety costs related to traffic accidents could amount to more than $234 billion over the Passenger Economy era from 2035-2045.

- Highlights of future scenarios explored in the study include:

- Car-venience: From onboard beauty salons to touch-screen tables for remote collaboration, fast-casual dining, remote vending, mobile health care clinics and treatment pods, and even platooning pod hotels, vehicles will become transportation experience pods.

- Movable movies: Media and content producers will develop custom content formats to match short and long travel times.

- Location-based advertising: Location-based advertising will become more keenly relevant, and advertisers and agencies will be presented with a new realm of possibilities for presenting content brands and location.

- Mobility-as-a-perk: Employers, office buildings, apartment complexes, university campuses and housing estates will offer MaaS to add value to and distinguish their offer from competitors or as part of their compensation package.

The Passenger Economy report was sponsored by Intel and developed by Strategy Analytics.

Foley Shows Barriers Confusion Between Connected Cars and Autonomous Cars & IP Ownership

Foley’s 2017 Connected Cars & Autonomous Vehicles Survey found that traditional automakers and suppliers have been joined by emerging and mature technology companies in the race to fill the streets with driverless cars. Foley interviews not consumers but automotive industry insiders Foley’s shows barriers to these technologies reaching their growth potential and gaining acceptance by the general public.

As for autonomous vehicles, the biggest perceived barrier among our respondents is reluctant consumers who may be concerned about the safety and viability of riding in self-driving cars and sharing the road with others. Thirty-five percent of respondents selected safety as the biggest obstacle to growth for autonomous vehicles, followed closely by consumer readiness toadopt (24 percent).

Foley’s 2017 Connected Cars & Autonomous Vehicles Survey found that traditional automakers and suppliers have been joined by emerging and mature technology companies in the race to fill the streets with driverless cars. However, there remain barriers to these technologies reaching their growth potential and gaining acceptance by the general public.

Connected Car/Con-Fusion

While the terms “connected cars” and “autonomous vehicles” are often used interchangeably, there are clear differences in where the technologies currently stand and their obstacles to growth. For connected cars, which have sensor-enabled communication systems, the largest percentage of respondents (31 percent) view cybersecurity and privacy issues as the most pressing concern. By contrast, respondents identified safety (35 percent) and consumer readiness to adopt (24 percent) as the top obstacles to advancing autonomous vehicle development.

Respondents expect the automotive sales process to continue evolving as new technologies enter the market. The vast majority (77 percent) anticipate that automakers will bundle more connected services and/or autonomous features at the point of sale, while roughly half (46 percent) predict that sellers will increasingly leverage vehicle data to guide the sales process.

While survey respondents underscored the importance of simultaneously devoting resources to connected cars and autonomous vehicles, more than half (54 percent) struggle to fund and commit the necessary time to develop and implement these technologies. Concerns around the shortcomings of roads and public infrastructure (39 percent) and regulation and legal risks (37 percent) were also top of mind.

IP Concerns by Industry

In developing technology for connected cars and/or autonomous vehicles, respondents identified cybersecurity attacks (63 percent) and intellectual property protection (58 percent) as most concerning to their companies.

Pavan Agarwal, partner in the Washington, D.C. office and former chair of Foley’s IP Department stated “Whether a company focuses more on developing hardware components or software solutions, they need to be hyper-attuned to leveraging their own IP to gain and protect market share, as well as to addressing risk from competitors’ IP.”

More than 80 executives, a majority with C-suite or director-level titles, at leading automakers, suppliers, startups, investment firms and technology companies completed the 2017 Connected Cars & Autonomous Vehicles Survey. The results were released in conjunction with Foley’s Connected Vehicles and Emerging Technologies in the Automotive Industry event, held on October 24, 2017 in Palo Alto.

Car Shopping Website Interviews Car Shoppers Look to the Future of Car Buying

Edmunds.com is a media outlet designed to sell advertising to atuomakers and car dealers to sell cars. Edmunds.com found that aar shoppers are more ready for autonomous vehicles than they may realize, according to a new report from Edmunds. More than 60 percent of new vehicle models today can be purchased at Level 1 or Level 2 autonomy, as defined by the Society of Automotive Engineers. Five years ago less than a quarter of new vehicle models offered these features.

In a recent Edmunds survey, more than 40 percent of consumers said they would spend between $1,000 and $2,000 more for a vehicle that had active safety features. Blind-spot detection, pre-collision warning systems and lane keeping assist are the top features consumers said they’re willing to pay a premium for.

Which autonomous features would you be willing to pay extra for on your next vehicle?

- Adaptive cruise control- 34%

- Automatic Parking -33%

- Lane Departure Warning/lane keeping assit 41%.

- Blind-spot detection-61%

- Pre-collison system- 52%

- I wouldn’t pay exra 24%

How much more would you be willing to pay to have a vehicle with one

or more autonomous features?

Less than $1,000 – 16%

$1,000 – $2,000 – 42%

$3,000 or more -42%

When we look at the people who can afford to buy a $35,000 car those 44-55 years-old 55%. won’t fell safe 55-64 71% won’t feel safe and 72% con’t feel safe. However and Edmund’s news release it stated

“As automakers look to build this future buyer base, courting millennials is particularly important as they’re the ones who are most ready to be early adopters. In a recent Edmunds survey, 65 percent of millennials said they would trust a Level 4 autonomous vehicle, and 35 percent said they would buy a Level 4 autonomous vehicle if it becomes available within the next five years. Only 16 percent of millennials surveyed said they would never buy an autonomous vehicle, compared to nearly 50 percent of those 55 years old and older.”

The Politics of Autonomous Cars

Americans are still leery of autonomous vehicles and doubt that they can provide a safer mode of transportation, accoridng to a Morning Consult/POLITICO poll in September. They interviewed voters, not car buyers.

Thirty-five percent of respondents said the automated technology is less safe than human-operated vehicles, while 18 percent said autonomous vehicles have about the same level of safety as human drivers.

Twenty-six percent said they didn’t know or had no opinion, according to the national sample of 1,975 voters.

A February 2016 poll by Morning Consult found that voters were similarly suspicious of driverless vehicles, with 43 percent of respondents saying self-driving cars aren’t safe and 32 percent saying they are. Twenty-five percent said they didn’t know or had no opinion.

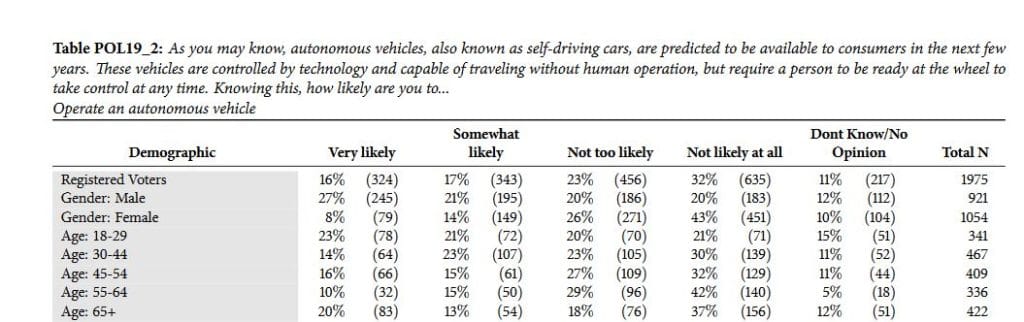

The recent survey, conducted Sept. 7 through Sept. 11, found that respondents are not likely to ride in, operate or purchase an autonomous vehicle when self-driving cars become available to consumers in the coming years. Thirty-eight percent said they were somewhat or very likely to ride as a passenger in an autonomous vehicle, while 51 percent said they were not too likely or not likely at all.

Thirty-three percent of respondents said they were very or somewhat likely to operate an autonomous vehicle, and 28 percent said they were likely to purchase one. Sixty-one percent said they aren’t likely to buy self-driving cars once they become available.

Thirty-one percent of adults under the age of 30 said autonomous vehicles are safer than the average human driver, compared with 20 percent of poll respondents 65 and up who said the same. The poll has a margin of error of plus or minus 2 percentage points.

Gartner 55% Will Not Ride in a Fully Autonomous Vehicle

Gartner Inc. is another industry analyst and is looking at the key to autonomouse adoption which is consumer acceptance. Gartner’s news release that teased with fact is to sell it’s research reports to businesses and investors.

Gartner, Inc. expects to see multiple launches of autonomous vehicles around 2020. However, the full impact of autonomous vehicle technology on society and the economy will not begin to emerge until approximately 2025. Consumer and social acceptance is a key driver in autonomous vehicle adoption.

The Gartner Consumer Trends in Automotive online survey, polled 1,519 people in the U.S. and Germany, found that 55 percent of respondents will not consider riding in a fully autonomous vehicle, while 71 percent may consider riding in a partially autonomous vehicle.

Concerns around technology failures and security are key reasons why many consumers are cautious about fully autonomous vehicles.

“Fear of autonomous vehicles getting confused by unexpected situations, safety concerns around equipment and system failures and vehicle and system security are top concerns around using fully autonomous vehicles,” explains Mike Ramsey, research director at Gartner.

Survey respondents agreed that fully autonomous vehicles do offer many advantages, including improved fuel economy and a reduced number and severity of crashes. Additional benefits they identified include having a safe transportation option when drivers are tired and using travel time for entertainment and work.

The survey found that consumers who currently embrace on-demand car services are more likely to ride in and purchase partially and fully autonomous vehicles. “This signifies that these more evolved users of transportation methods are more open toward the concept of autonomous cars,” said Gartner’s director or research, Mike Ramsey.

The percentage of people who used a mobility service, such as Uber or Car2Go, in the past 12 months rose to 23 percent from 19 percent in a similar survey conducted two years earlier. However, the transition to dropping a personally owned vehicle will be challenging outside of dense urban areas. For the automobile owners surveyed with a driveway or easily accessed parking, nearly half of the respondents said they would not consider giving up their own vehicle, even if they saved 75 percent over the cost of owning their own car. The ability to leave at any moment is the most cited reason for not replacing personal vehicles with on-demand car services. Trust and personal safety are also top concerns.

“The automotive industry is investing in new safety and convenience technology at a rate not seen since the dawn of the automobile. The experience of owning and operating a car will be dramatically different in 10 years,” Mr. Ramsey said.

Dozens of companies are currently developing sensors and other technologies required to enable vehicles to detect and understand their surroundings. As of mid-2017, more than 46 companies are building artificial intelligence (AI)-based software to control an autonomous vehicle and make it operate in the world.

Functional safety requirements, road and driving rules, and liability issues are top regulatory concerns. Discussions about functional safety requirements are in their infancy. Establishing these requirements is imperative to ensuring overall safety.

“In order for the number of autonomous vehicles to be high enough to become a highly disruptive influence, governments must develop a coherent set of regulations across states and countries,” said Ramsey.

“Autonomous driving technology will fundamentally transform the automotive industry, changing the way vehicles are built, operated, sold, used and serviced,” said Mr. Ramsey.

The cost of technology will influence autonomous vehicle adoption. Autonomous vehicle sensors are expensive, as are the internal computing platform and infrastructure they require. Early autonomous vehicles are likely to cost more than $100,000 because of new technologies and the initially low volume of vehicles.

Autonomous Cars and the Insurance Industry

Now let/s look Berg insights insight. Berg Insight is a research firm predicts the impac to technology in the future. In this twist of fate, the company contends that once a car becomes fully autonomous it’s not the driver who needs insurance but the automaker, who is liable.

Berg Insight, the world’s leading M2M/IoT market research provider, released new findings about the effect of autonomous cars on auto insurance. Several major trends are currently impacting the motor insurance market, which has resulted in higher competitiveness and new stakeholders on the market. The integration of telematics technology constitutes the latest revolution for the automotive insurance industry.

Telematics enables automotive insurers to improve pricing mechanisms based on actual driving data, gain better control of claims and differentiate their offerings to current and prospective policyholders. Berg Insight is of the opinion that the next revolution of the motor insurance industry is expected to be the introduction of semi- and fully-autonomous vehicles. The total number of new registrations of autonomous cars is forecasted to grow at a compound annual growth rate (CAGR) of 62 percent from 0.2 million units in 2020 to reach 24 million units in 2030. The active installed base of autonomous cars is forecasted to have reached about 71 million at the end of 2030. These figures include SAE Level 3 and 4 cars.

As autonomous vehicles emerge, new challenges and opportunities surface for insurers. One opportunity for insurance companies is for instance the risks related to the complex software embedded in the autonomous vehicles. Autonomous driving will furthermore transform mobility, remodel the concept of owning a car and open new opportunities for insurers specialised on products such as ride- and carsharing insurance. Autonomous car technology is expected to develop significantly in the upcoming years and insurance companies must adapt to the market needs and the emerging technology.

“Innovations within semi-autonomous advanced driver assistance systems (ADAS) including safety-enhancing features such as emergency break assist (EBA) systems can already make policyholders eligible for sizeable discounts on traditional insurance”, said Martin Svegander, IoT/M2M Analyst, Berg Insight.

Increasing the share of driving automation to the point where the driver’s influence eventually becomes virtually negligible poses an interesting scenario from the auto insurance perspective. This scenario will create a range of complex regulatory challenges that can affect the insurance market profoundly.

“If the vehicles are truly autonomous, one can even argue that accident liability should be assumed by the OEMs and associated suppliers rather than the individual car owners”, continues Mr Svegander.

Berg Insight believes that insurance telematics technology will have a crucial role for risk analysis of accidents related to autonomous driving, not the least as a means to determine the liable party. Although cautious players within the insurance industry might argue that it will most likely take decades before autonomous vehicles replace conventional cars, the technology for self-driving cars is already making its way into today’s car models. “Autonomous cars are paving the way for the future and it is important for the insurance industry to take an active part of the revolution” concludes Mr. Svegander.

How to Learn Educate

The JD Power e 2017 J.D. Power SSI pilot report found that 38% of respondents would like to learn about autonomous vehicle features through online websites/videos; 30% in-person with a salesperson; 30% in-person with a technology specialist; and 8% through call center support..

Overcoming Self-Driving FEAR Hire a Famous Athelete

Jack Weast, a senior principal engineer and the chief systems architect for Intel’s Autonomous Driving Group noted the promise of autonomous vehicle technology is tantalizing to say the least. Some experts predict that we can save millions of lives and grant mobility to all just by removing humans from the driver’s seat. But the difference between theory and practice comes down to this: People are downright scared of robot cars. In fact, a recent AAA study found that 75 percent of Americans are afraid to ride in self-driving cars.

Intel, believes it can overcome consumer apprehension by creating an interactive experience between car and rider that is informative, helpful, and comfortable – in a word: trustworthy. Intel’s xperience research team showed this potential in a recent Trust Interaction Study with autonomous car passengers.

This limited, qualitative study was conducted with consumers who had no previous exposure to driverless cars other than those they had seen in their city. They were invited to take a ride in a driverless test car in exchange for their feedback about the experience. Five trust interactions were prototyped and evaluated: requesting a vehicle, starting a trip, making changes to the trip, handling errors and emergencies, and pulling over and exiting. We interviewed them before and after their ride and also recorded their reactions during the experience.

The focus was on trusting the machine and understanding the human-to-machine interfaces (displays, touch screens, vocal cues and more) that provide the means for passengers to interact with their driverless cars. Although limited in scope, the results were unanimous. Every single participant experienced a huge leap in their confidence level after their journey. Even those who came in apprehensive about self-driving cars acknowledged that autonomous vehicles are a safer mode of transportation and felt excited about the growth of this market.

While much was learned in this study, it is only the beginning. Our research identified seven areas of tension – or contradictory perspectives – that warrant further exploration. Intel plans to continue user experience research in these areas. Intel hired world-famous athlete LeBron James to show he’s not afraid of autonomous driving.

Way Too Much from Waymo

Waymo recently hosted a bevy of reporters to an autonmous driving party at it headquarters for extensive coverage. AUTO Connected Car News was not invited. Before that Waymo released it’s 43 page safety report. Making the report 43 pages long is brilliant marketing because nobody really wants to read 43 pages.

Waymo recently hosted a bevy of reporters to an autonmous driving party at it headquarters for extensive coverage. AUTO Connected Car News was not invited. Before that Waymo released it’s 43 page safety report. Making the report 43 pages long is brilliant marketing because nobody really wants to read 43 pages.

Waymo states it will have a ride-sharing app that customers can use to hail a car just as they do with Uber or Lyft. There will be controls and information screens inside the vehicle. Cars will “pull over” button to stop the car safety and disembark the vehicle. Riders can also call the ride support team to get answers.

Ride Hailing Autonomous Cars Will Create More TRAFFIC

A report on the adoption and use of ride-hailing finds that services like Uber and Lyft attract passengers away from public transit, biking, and walking, in addition to serving as a complementary mode (e.g., for commuter rail). Since ride-hailing passengers are the future of self-driving users this report warrants attentions. The UC Davis Institute of Transportation Studies research is the first-ever study with representative data from major cities across America on ride-hailing and its impact on travel decisions. The report was produced by researchers at the University of California, Davis Institute of Transportation Studies

Uber and Lyft and Autonmous Ride-Hailing Most likely Add to traffic in major cities today

Academic research is the most pure because it is not being directly paid for by industry. U.C. Davis is the at the core of automotive policy in the California and the United States. Previously the University of Michigan Transportation Research Institute reported that autonomous vehicles may reduce the number of vehicles a family needs, but may lead to an increase in total miles driven.

In a new study based on data collected in major cities across America by Regina Clewlow, PhD at U.C. Davis, found that a large portion of travelers are substituting ride-hailing in place of public transit, biking, and walking trips, or would not have made the trips at all (Fig. 1). These trips, which are being substituted for or generated by ride-hailing, are most likely adding vehicles to the road in major metropolitan areas. There is a significant need for future research on the topic — the most recent findings from major cities seem to suggest that ride-hailing is likely adding to, not reducing traffic congestion.

In a new study based on data collected in major cities across America by Regina Clewlow, PhD at U.C. Davis, found that a large portion of travelers are substituting ride-hailing in place of public transit, biking, and walking trips, or would not have made the trips at all (Fig. 1). These trips, which are being substituted for or generated by ride-hailing, are most likely adding vehicles to the road in major metropolitan areas. There is a significant need for future research on the topic — the most recent findings from major cities seem to suggest that ride-hailing is likely adding to, not reducing traffic congestion.

The research (and ride-hailing firms themselves) suggest that ride-hailing can be complementary to public transit. This is also true. However, this study finds that while some portion of individuals increase their transit use (an increase in commuter rail use), the net effect across the entire population is an overall reduction in public transit use and a shift towards lower occupancy vehicles (i.e. more cars).

Autonomous Hailed Vehicles = More Rides More Traffic More Woes

The broader implications of this shift in travel choice are critical notes the report’s author. Cities are grappling with how to plan for the potential introduction of autonomous vehicles, which many believe will be deployed through shared services, not to mention the ever-rising impacts of the transportation sector on energy use and emissions. As of 2016, transportation surpassed the power sector as the largest contributor to the U.S. climate problem.

Many believe that sharing vehicles can help address growing transportation woes — however, U.C. Davis research shows that sharing vehicles is not enough

Evolution of shared mobility services

Much of prior academic research on impacts of shared mobility services study on carsharing 1.0 — that is, early models of carsharing where vehicles were picked up and returned to the same location, typically through hourly rentals (Fig. 2). A key takeaway from this recent report is that not all shared services can be viewed as the same.

The adoption rates of ride-hailing far outpace the adoption rates of prior carsharing models. Older business models of carsharing have attracted only 2 million members in North America and close to 5 million globally — over roughly 15 years. Conversely, the adoption ride-hailing (e.g., Uber, Lyft, Didi), the latest model of “shared mobility” is estimated to have grown to more than 250 million users globally within their first five years of existence.

Prior research shows that carsharing members (e.g. Zipcar, car2go) were highly educated and environmentally oriented. The widely cited vehicle reduction “impacts” of carsharing were more likely due to self-selection bias rather than a significant causal relationship. Early carshare members were motivated to reduce their environmental footprint, and they represent less than 1% of the entire U.S. population.

Ride-hailing, on the other hand, has captured a much broader swath of the population. Interestingly, but perhaps not surprisingly, we find that more than half of carsharing users surveyed dropped their membership, with 23% citing their use of services like Uber and Lyft as the top reason they no longer use carsharing.

The research study revealed a number of additional insights into the travel decisions made by individuals and households, including the demographics of typical ride-hailing adopters, frequency of ride-hailing use, and vehicle ownership decisions.

Key findings include the following:

- Nearly a quarter (24%) of ride-hailing adopters in metropolitan areas use ride-hailing on a weekly or daily basis.

- Parking represents the top reason that urban ride-hailing users substitute a ride-hailing service in place of driving themselves (37%).

- College-educated, affluent Americans have adopted ride-hailing services at double the rate of less educated, lower income populations.

- Among adopters of prior carsharing services, 65% have also used ride-hailing. More than half of them have dropped their membership, and 23% cite their use of ride-hailing services as the top reason they have dropped carsharing.

- Ride-hailing users have higher personal vehicle ownership rates than those who use “transit only”: 52% versus 46%.

- Among non-transit users, there are no differences in vehicle ownership rates between ride-hailing users and traditionally car-centric households.

- Those who have reduced the number of cars they own and the average number of miles they drive personally have substituted those trips with increased ride-hailing use. Net vehicle miles traveled (VMT) changes are unknown.

- After using ride-hailing, the average net change in transit use is a 6% reduction among Americans in major cities.

- As compared with previous studies that have suggested shared mobility services complement transit services, the substitutive versus complementary nature of ride-hailing varies greatly based on the type of transit service in question. On average, ride-hailing hailing appears to reduce bus ridership and complement commuter rail.

- 49% to 61% of ride-hailing trips would have not been made at all, or by walking, biking, or transit.

- Directionally, based on mode substitution and ride-hailing frequency of use data, ride-hailing is currently likely to contribute to growth in vehicle miles traveled (VMT) in the major cities represented in this study.

The full report can be downloaded through the ITS website.

Regina Clewlow, PhD is a leading transportation researcher on shared mobility and autonomous vehicles. She received her Ph.D. from MIT in Transportation Systems, and has served as a research scientist at UC Berkeley, Stanford, and UC Davis.

After reading all the research it becomes what can we extrapolate? Autonomous driving by ride-hailing services may cut down not on traffic but on bus ridership. Autonomous cars could supplment the highly-educated public that doesn’t like to drive or find parking places. Self-driving is driving all kinds of research and expectations and investments. What do you think?