Data from Edmunds.com, Kelley Blue Book and ALG show average transaction either $33,226, $35,263 or $35,428 with incentives around $3,500 – $3,800.

The average transaction price of a new vehicle hit a record $35,428 in October, according to the analysts at Edmunds.com. This is a 2 percent increase compared to October of 2016 and an 12 percent increase compared to October of 2012. The average down payment on a new car also reached record territory in October, hitting $3,966. This is up $374 compared to October of 2016 and $454 from five years ago.

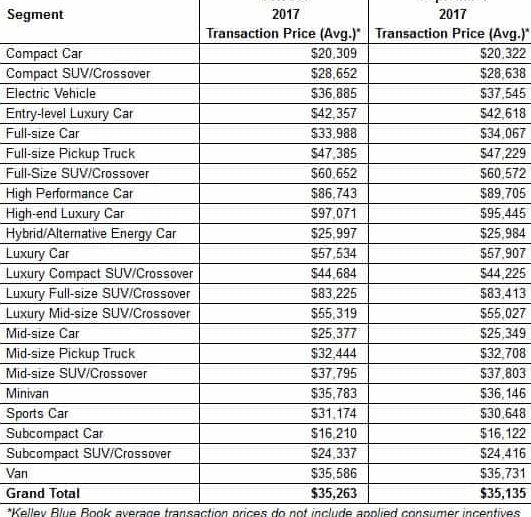

The analysts at Kelley Blue Book today reported the estimated average transaction price (ATP) for light vehicles in the United States was $35,263 in October 2017. New-car prices have increased by $101 (up 0.3 percent) from October 2016, while climbing $128 (up 0.4 percent) from last month.

The analysts at Kelley Blue Book today reported the estimated average transaction price (ATP) for light vehicles in the United States was $35,263 in October 2017. New-car prices have increased by $101 (up 0.3 percent) from October 2016, while climbing $128 (up 0.4 percent) from last month.

ALG estimates ATP for a new light vehicle was $33,226 in October, up 0.9 percent from a year ago. Average incentive spending per unit grew by $295 to $3,820 on a year over year basis. The ratio of incentive spending to ATP is expected to be 11.5 percent, up from 10.7 percent a year ago.

“The shift away from passenger cars in favor of trucks and SUVs is impacting all facets of the auto market,” said Jessica Caldwell, executive director of industry analysis for Edmunds.com. “Interest rates are rising and bigger vehicles have higher price tags, but so far car shoppers don’t seem to be shying away from putting more money down or having a higher monthly payment to drive the vehicle they want.”

“Transaction prices continue to rise at a slower pace than we’ve seen recently, expected to be just $100 higher than this time last year,” said Tim Fleming, analyst for Kelley Blue Book. “Prices in the third quarter were up just 1 percent after averaging 3 percent gains in the first half of the year. While Kelley Blue Book expects solid sales in October 2017 at 17.9 million SAAR, flat transaction prices combined with ever-growing incentive spending signal headwinds for the new-vehicle market as 2017 nears its end.”

Despite strong demand for trucks and SUVs, automakers are struggling to move lagging 2017 inventory off dealer lots. In October, 72 percent of new vehicles sold were 2017 model year, while last October, 60 percent of new vehicles sold were 2016 model year. Five years ago, only 46 percent of the new vehicles sold in October were from the 2012 model year. Incentives last month remained at a near-record high of $3,472 per vehicle; however, Edmunds analysts say automakers are going to have to be even more aggressive if they want to move inventory.

“Clearing out old inventory is expensive, especially when automakers are forced to deeply discount passenger cars, which already have thin profit margins,” Caldwell said. “With two months left in the year and this much inventory remaining, we expect to see some very creative year-end sales events to entice car shoppers.

Fiat Chrysler’s average transaction prices rose 4 percent in October 2017, as the Jeep brand increased 3 percent. The redesigned Jeep Compass jumped 6 percent, while the winddown of the Jeep Patriot also is helping drive average prices up. Dodge climbed by 10 percent on the strength of the Durango SUV and its new SRT performance trim.

Volkswagen Group’s average transaction prices were among the best performers year-over-year, up 2 percent for the month. The Volkswagen brand was up 4 percent, in large part to the recently introduced Atlas SUV and redesigned Tiguan, which rose 6 percent. Audi was up 4 percent, as the redesigned A5 climbed 4 percent on the strength of its new Sportback body style.

ALG, projected U.S. revenue from new vehicle sales will reach $45 billion for the month of October, down 0.7 percent from a year ago.

ALG expects a loss of $294 million in revenue for automakers versus October 2016. Additionally, incentive spending is projected to increase 8.4 percent.

“ATP experienced substantial growth in October, fueled by light trucks and a richer mix of new 2018 model year vehicles,” said Eric Lyman, ALG’s Chief Industry Analyst. “ALG also expects the industry to begin pulling back on incentive spending thanks to much needed production cuts across major automakers.”