Reasearch shows that most generations are afraid of self-driving. Technology choice is not affected much by price. However, safety is important to car buyers, regardless of price reports J.D. Power.

The study found that safety is still important to consumers:

- AEB: The 31% of consumers willing to pay $700 for the advanced version of automatic breaking system (adds steering) is greater than the percentage of consumers who would pay for less expensive technologies like digital key at $250; dash camera at $300; and mobile system control at $400.

- Collision protection and driving assistance-related technologies comprise most of the technologies with the highest pre-price interest, while features in the entertainment and connectivity, and comfort and convenience categories show the lowest pre-price interest.

- However, similar to the 2016 study, consumers this year showed great interest in collision protection and driving assistance technology. Six of the top 10 features that consumers were most interested in before learning the price were:

- smart headlights.

- camera rear-view mirror.

- emergency braking and steering system.

- lane change assist.

- camera side-view mirrors.

- advanced windshield display.

Generation Gaps in Wants/Needs

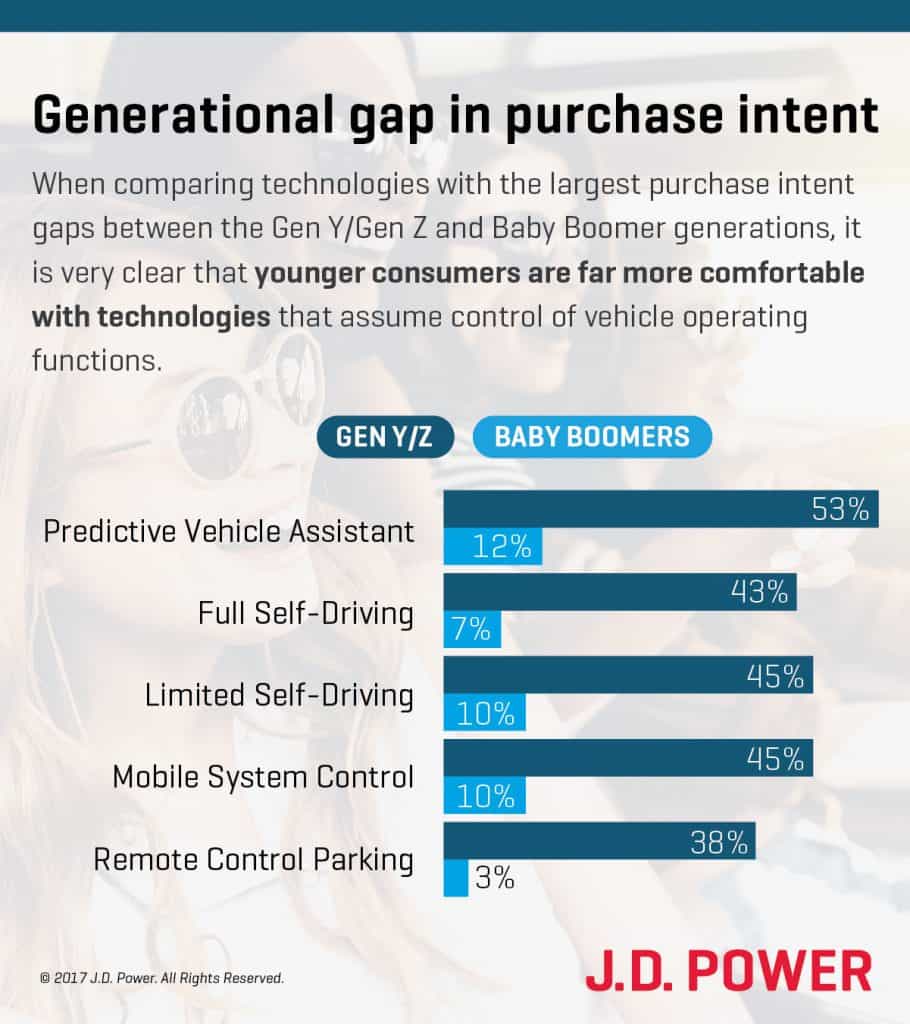

- When looking at technologies with the largest purchase intent gaps between the Gen Y/Gen Z and Boomer generations, younger consumers are far more comfortable with technologies that assume control of vehicle operating functions. Examples include allowing mobile devices to take control of infotainment systems; an in-vehicle artificial intelligence (AI)-based assistant; and autonomous driving and parking technologies.

- For all five of the technologies with the largest purchase intent gap, Gen Y/Gen Z purchase intent is greater than Boomers, who say they definitely/probably are interested in a feature even before they know the price.

- Gen Z has the highest interest in all alternative mobility types, including 50% indicating they are definitely/probably interested in mobility sharing/co-ownership; 52% for journey-based ownership; 56% for unmanned mobility; and 56% for mobility-on-demand.

- Compared with 2016, 11% more Gen Z consumers and 9% more Pre-Boomers say they “definitely would not” trust automated technology.

“Along with collision mitigation, there are many benefits to autonomous vehicles, including allowing those who are unable to drive in today’s vehicles to experience freedom of mobility,” Kolodge said. “Interestingly, though, 40% of Boomers do not see any benefits to self-driving vehicles. Automated driving is a new and complex concept for many consumers; they’ll have to experience it firsthand to fully understand it. As features like adaptive cruise control, automatic braking and blind-spot warning systems become mainstream, car buyers will gain more confidence in taking their hands off the steering wheel and allowing their vehicles to step in to prevent human error.”

The U.S. Tech Choice Study, examines consumer awareness, interest and price elasticity of various future and emerging technologies by vehicle make and consumer demographic.