Eight in 10 new cars will be connected by 2020, however four in 10 drivers (39%) don’t know that these features exist in their own vehicles, according to research from TNS and the BearingPoint Institute.

Eight in 10 new cars will be connected by 2020, however four in 10 drivers (39%) don’t know that these features exist in their own vehicles, according to research from TNS and the BearingPoint Institute.

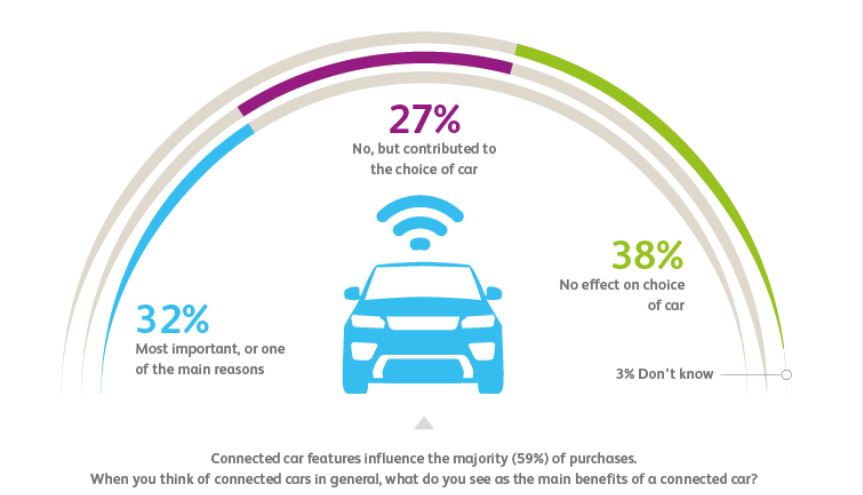

The survey of 3,700 connected car owners shows excitement about connected cars, especially navigation, driver assistance and in-car entertainment, with almost six in 10 respondents (59%) saying that connected features influenced their choice of vehicle and 32% saying it was an important criteria at purchase.

The study also highlighted the importance of ‘on-boarding’ customers during the sales process, with 48% of drivers who use connected features saying that the technology was demonstrated to them in the showroom, which is why test drives are growing in importance. Explaining and showing the technical capabilities of the car early in the sales process is critical to the uptake and use of connectivity.

OEMs also need better training for dealership staff to demonstrate the benefits of connectivity. Customers often complained that dealership staff didn’t know enough about how the connected features worked, with many buyers saying they knew almost as much themselves.

Connected cars are the beginning of a new era in automotive. OEMs — are now selling a platform of digital services. Our study shows that the German premium OEMs are so far leading the way in terms of the quality and useability of their features. To really exploit this new era, all OEMs need to invest to ensure customers are aware of and are enjoying these connected features, advise Sarah-Jayne Williams, Part

Despite this, OEMs are struggling to use connectivity features to open new revenue streams, build stronger relationships with customers and boost brand awareness. This is leaving the door open for companies like Uber and Apple, which are already investing in infotainment and geo-location functions, to steal market share in this area.

Car manufacturers need to act fast if they are to avoid being overtaken by the big tech players. Smartphones are already integrating entertainment and navigation functionality with existing on-board systems, such as Apple’s Car Play and the Google powered Open Automotive Alliance. Smartphone apps can help drivers find their cars if they’ve forgotten where they parked, unlock them remotely and even prepare the interior temperature long before the driver arrives.

OEMs therefore need to find ways to either partner with tech companies or invest in them as Audi, BMW and Mercedes have recently done with their $3 billion purchase of the Nokia/Microsoft HERE map and navigation platform to make their features even better than the software specialists’ products.

Remy Pothet, Global Automotive Sector Head at TNS